The Q3 2022 benchmarking report for UK convenience stores has just been published. Learn how the top 8 UK convenience stores perform across the digital space.

The latest Q3 2022 benchmarking report for UK Convenience stores has just been published. It covers the largest 8 national convenience stores, including Premier, Spar, Budgens, One Stop, Nisa, McColl’s, Londis, and Costcutter - it highlights year-on-year digital performance, plus winner and loser comparisons in 20+ online performance metrics.

The research gives an inside track on who is winning the biggest share of voice online, and quantifies the gaps, risks and missed opportunities for other convenience stores to win brand exposure locally, online orders and in-store footfall. The report highlights quick wins that will improve enquiries from your online strategy and identifies the barriers that may be reducing your site’s ability to optimise digital performance.

To see a preview and contents page of the Q3 report, click here. To get a copy of the full report and the key take-aways, please complete the enquiry form or schedule a call.

You can also find out how these 8 convenience stores performed against last quarter, by revisiting our Q2 report round-up.

What The Industry Research Report Covers

The 70+ pages of research benchmarks each brand based on 50+ metrics and indicators of successful digital strategy, including organic visibility, domain authority, paid media ads, conversion performance, technical performance, site speed, universal search, content, social ads, accessibility, and mobile performance.

Driving Optimal ROAS from Paid Media Channels

Some of the leading players in the space are high spenders on paid media channels such as Google, Bing & Facebook - but have a poor or sub-optimal conversion improvement strategy. Without an optimised, sophisticated conversion strategy that maximises the conversion rate, the return on investment is unsustainable or will under-perform. Scaling spend on paid media is not achievable unless the conversion rate delivers optimal performance in the sector. Some in the space have paid media spend levels from 30k+ per month but dedicate minimal resources and budgets to conversion testing. Given the cost per clicks on ad networks will continue to rise, we recommend spending at least 10% of your paid media budget on ongoing conversion optimisation testing schedules to ensure your paid media ROI maintains long term viability, competitive advantage, and sustainability.

Technical Website Compliance

Savvy digital marketers know that having a technically sound website is an essential component of a successful fully integrated digital strategy - plus a site capable of maximising conversion performance.

In our last report, we saw that UK convenience stores generally performed well when we reviewed their sites for errors. Our biggest find in Q2 was 627 404 error codes for Nisa, who are now recording only 6! Taking decisive action by tackling any errors head-on ensures your site is easy (and pleasant) to navigate – Nisa have done well to knock down such a significant level in a short space of time.

Site Speed & Conversion Rate Performance

When 62% of consumers are less likely to convert if they have a negative mobile site experience, ensuring that your site is quick and easy to load makes a significant improvement on your overall conversion rates.

For convenience stores, mobile page speed is especially important as users looking for stores near them will, most likely, be on a mobile device. In July, we found that none of the UK convenience stores were achieving even an okay score of 50-89, suggesting a significant problem within the sector. However, we've seen improvements from all convenience stores, with McColl's now achieving a good score of 90 this is great news for McColl's who are one of the first brands we've seen in our research to hit this figure! One Stop, Budgens, Londis, and Premier have all now secured a spot in the 'okay' range of 50-89.

Building Competitive Advantage with Domain Authority

Domain authority is an essential metric for measuring the effectiveness of SEO performance, and helps create a reliable overall gage of how effective your site is at achieving organic traffic, ie. ‘free’ traffic that isn’t gained through sponsored ads.

Domain authority is considered average between 40 and 50, good between 50 and 60, and excellent above 60. ‘Good’ DA score depends on the competition level of the industry. However, a ‘good’ DA really comes down to how your competitors are performing.

We’ve seen no change in Domain Authority since our last report. Nisa remain on top with a DA of 63 while McColl’s have the lowest score of 43. Though we’ve seen no changes, McColl’s should be looking at how they can improve their DA, before other convenience stores swing into action.

Organic Performance – Mobile & Desktop

A strong organic performance is strategically important as it ensures your site ranks above competitors for key, transactional keywords. When 93% of your customers won’t go past the first page of Google, your absence or lack of targeting for essential keywords will cost you conversions.

Spar had the biggest YoY improvement in our last report. Though they remain on top in terms of mobile traffic, Spar’s mobile traffic fell by 19% YoY in Q3. However, when we looked further into Spar's keyword performance, we saw they were still ranking highly for their chosen target keywords, and that the search volume on these had simply fallen. Though Spar are seeing a reduction in traffic, they're still commanding as much visibility on their existing keywords as they were in Q2. While, in our last report, all but two convenience stores had seen YoY traffic growth, this quarter only Costcutter and McColl’s saw a year on year improvement in mobile traffic (+27% and +28% respectively).

Universal Search Opportunity

Google Universal Search Results is an evolving opportunity to make your pages visible on a SERP (Search Engine Results Page). Universal results often appear before traditional listings and are eye-catching for users. Universal search results refer to rankings on a SERP that are not the traditional ‘blue line’ Google link, and a brand can appear for universal search results without being strong in standard rankings.

Spar remain on top when it comes to Universal Search Results, but our biggest improver was One Stop, who have grown from 165 People Also Ask results in Q2 to 322 in Q3. With People Also Ask results being likely to scoop up traffic from potential customers with product or recipe enquiries, it’s important to stay on top of your appearances, in order to not lose ground to competitors.

The Longtail Keyword Opportunity

Longtail keywords are often considered high intent and potentially more likely to convert as a searcher is being more specific. Optimising for longtail keywords also puts your content strategy in a strong position to rank for brand new search terms as they enter Google’s index.

Last quarter, Costcutter were not ranking for any long tail keywords in positions 1-3. In Q3, Costcutter ranked for 66 longtail keywords in the top three positions. Though this doesn’t match up to Spar’s 1,231 longtail, top three keywords, it does show a steady improvement that will grow over time.

Facebook Adverts

With the number of Facebook users in the United Kingdom (UK) forecast to hit over 42 million users by 2022, it is not surprising that companies have jumped at the opportunity to advertise on the social media platform. Facebook’s UK digital advertising revenue has been estimated to have breached 2.6b GB pounds in 2019.

Below, we can see examples of Costcutter’s Facebook ads. Though at first glance they’ve missed a trick by not varying their creative, we can see that they’re using variations on similar copy to see what back-to-uni messaging lands best with their student audience. Adding in slight variations on copy or images (as opposed to changing everything at once) helps brands fine-tune what works for them, and create better-performing ads in future campaigns.

Top Social Shares & Content

When it comes to social media and on-site content strategies, it is important to release content that has a longer shelf life. An article is considered 'Evergreen' if it has maintained its relevancy to an audience for longer. It's great for your brand engagement, but great for Google too, who will recognise content which achieves traffic over a long period of time.

As we mentioned in our last report, the huge range of products stocked by convenience stores makes way for plenty of room for content production. However, Londis and Costcutter are still the least consistent when it comes to content-production. Though Costcutter are one of the two convenience stores to gain traffic YoY this quarter, they remain the middle of the pack on Domain Authority, with a score of 49. Working on their content production, particularly with a focus on shareable content, will help grow authority and, in turn, improve their traffic acquisition even further.

Website Readability & Accessibility

20% of people in the UK have a disability – 2 million of which are people living with sight loss. In addition, 1 in 12 men and 1 in 200 women have some degree of colour vision deficiency. When websites are not designed to meet these needs, brands lose customer interest as they turn elsewhere.

In our last report, we saw that our 8 convenience stores are fairly on top of any accessibility issues, with fewer errors appearing than we usually come across. However, Nisa have seen a slight increase in site errors, going from 76 in Q2 to 99 in Q3. Tackling site errors periodically, particularly when they are manageable, helps brands keep on top of good-practice and avoid a gradual build up to a more challenging level.

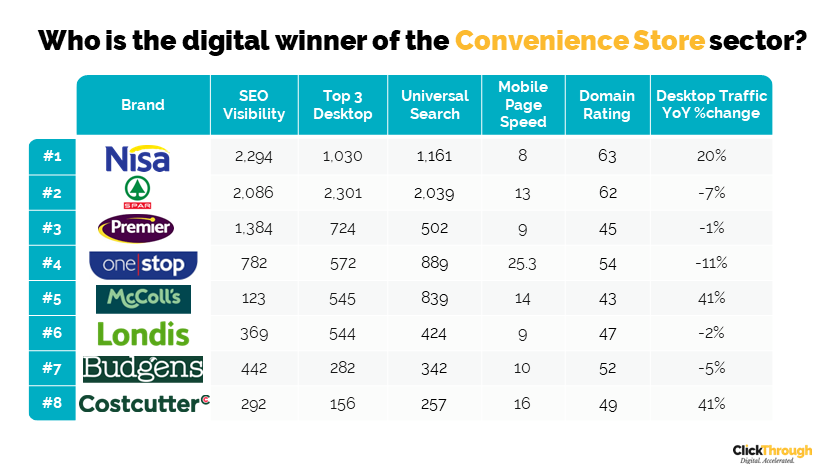

Q3 2022 Winners and Losers Summary

For a glance into just 6 of the metrics we evaluated these top 8 convenience stores on, check out our quick-look table below;

Since our Q2 report, we’ve seen movement across the board. Nisa have overtaken Spar to become the best digitally performing UK convenience store, while Budgens have improved from 8th to 7th place. The biggest change has come from Costcutter, who have fallen from 4th to 8th place.

GET THE FULL 70-PAGE Q3 2022 REPORT

To get a copy of the full report, please complete the enquiry form. If you want to talk to us about accelerating your digital performance, please call us on 01543 410014 or schedule a call with Mike Movassaghi.

Let's be social

Join our growing social communities to learn more about the benefits of digital marketing and the people who make us tick.