The Q3 2023 benchmarking report for UK health insurance providers has just been published. Learn how the top 12 UK health insurance providers perform across the digital space.

The latest Q3 2023 benchmarking report for UK health insurance providers has just been published. It covers the largest 12 national health insurance providers, including Bupa, Circle Health Group, Spire Healthcare, Nuffield Health, AXA UK, Simplyhealth, WPA Healthcare, Benenden Health, BHSF, Sovereign Healthcare, Vitality, and Westfield Health.

The research gives an inside track on who is winning the biggest share of voice online and quantifies the gaps, risks and missed opportunities for other health insurance providers to win brand exposure, increase online enquiries, and generate more policy sign-ups. The report highlights quick wins that will improve enquiries from your online strategy and will identify the barriers that may be reducing your ability to optimise digital performance.

To see a preview and contents page of the Q3 report, click here. To get a copy of the full report and the key takeaways, please complete the enquiry form or schedule a call.

What The Industry Research Report Covers

The 70+ pages of research benchmarks each retailer based on 50+ metrics and indicators of successful digital strategy, including organic visibility, domain authority, paid media ads, conversion performance, technical performance, site speed, universal search, content, social ads, accessibility, and mobile performance.

Driving Optimal ROAS from Paid Media Channels

Some of the leading players in the space are high spenders on paid media channels such as Google, Bing & Facebook - but have a poor or sub-optimal conversion improvement strategy. Without an optimised, sophisticated conversion strategy that maximises the conversion rate, the return on investment is unsustainable or will underperform. Scaling spend on paid media is not achievable unless the conversion rate delivers optimal performance in the sector. Some in the space have paid media spend levels from 30k+ per month but dedicate minimal resources and budgets to conversion testing. Given the cost per clicks on ad networks will continue to rise, we recommend spending at least 10% of your paid media budget on ongoing conversion optimisation testing schedules to ensure your paid media ROI maintains long-term viability, competitive advantage, and sustainability.

Technical Website Compliance

Savvy digital marketers know that having a technically sound website is an essential component of a successful fully integrated digital strategy - plus a site capable of maximising conversion performance. Health insurance providers will want to ensure prospective customers can easily access key pages, such as pricing information, policy coverage details, and plan comparisons.

Vitality and AXA UK are returning the highest levels of 4xx errors, with 273 and 313, respectively. Health insurance providers have the benefit of not needing to manage large volumes of changing stock, so maintaining technical compliance is more straightforward than for e-commerce brands. Vitality and AXA must ensure users are not being blocked from any key conversion pages, and therefore dropping out of the sales funnel.

Site Speed & Conversion Rate Performance

When 62% of consumers are less likely to convert if they have a negative mobile site experience, ensuring that your site is quick and easy to load makes a significant improvement on your overall conversion rates. For health insurance providers, they'll want to provide an excellent customer experience at every touchpoint, giving the impression of quick service from the moment a user steps virtual foot on their site.

In our last report, we noted that six health insurance providers had hit the 'okay' mobile page speed benchmark score of 50. In Q3, only Benenden Health were within the 50-89 range, with a score of 56. Circle Health Group have seen the biggest fall in performance, falling from 83 to 36. However, though this might seem like cause for concern, we are seeing huge falls in performance across all sectors we specialise in, particularly at the top end of the scale. We'd still advise any brands concerned about their mobile page speed performance to identify whether there have been any recent changes to their site which could have impacted performance.

BUILDING COMPETITIVE ADVANTAGE WITH DOMAIN AUTHORITY

Domain authority is an essential metric for measuring the effectiveness of SEO performance and helps create a reliable overall gauge of how effective your site is at achieving organic traffic, i.e. ‘free’ traffic that isn’t gained through sponsored ads. Health insurance companies should consider what topics they can cover that are most likely to be picked up by external sites and gain backlinks - something engaging with a digital PR specialist will help with.

As in our last report, DAs for UK health insurance companies range from 81 (Bupa) down to 39 (Sovereign Health Care). Brands at the lower end of this scale should be considering how to expand their digital PR strategy and build their backlink profile.

Organic Performance – Mobile & Desktop

A strong organic performance is strategically important as it ensures your site ranks above competitors for key, transactional keywords. When 93% of your customers won’t go past the first page of Google, your absence or lack of targeting for essential keywords will cost you conversions. With growing concerns over NHS waiting times, and a need to access additional services, we'd expect to see some uplift within the private health insurance sector.

Of our health insurance providers, seven brands have seen an uplift in organic traffic compared to 2022, while 5 have seen a reduction. The biggest loss in Q3 was seen by Nuffield Health, who's total organic dropped by 35%. Westfield Health, who saw the biggest loss (of -32%) in our last report, have now reduced this to a 19% loss in traffic.

Universal Search Opportunity

Google Universal Search Results is an evolving opportunity to make your pages visible on a SERP (Search Engine Results Page). Universal results often appear before traditional listings and are eye-catching for users. Universal search results refer to rankings on a SERP that are not the traditional ‘blue line’ Google link, and a retailer can appear for universal search results without being strong in standard rankings. Results such as 'people also ask' give health insurance providers the opportunity to answer queries from potential policyholders directly from the SERP, even if they aren't appearing in position one.

In our last report, we noted that 'image pack' was the most-used Universal Search result. We've noted 'image pack' appearances have been dipping across the full scope of Universal Search, with 'people also ask' now appearing to be the most-favoured result for many sectors, including private health insurance providers. Bupa have made the most appearances for 'people also ask' queries, with 12,900.

The Longtail Keyword Opportunity

Longtail keywords are often considered high intent and potentially more likely to convert as a searcher is being more specific. Optimising for longtail keywords also puts your content strategy in a strong position to rank for retailer new search terms as they enter Google’s index. For health insurance providers, they'll want to pay particular attention to phrases including high conversion intent terms, such as 'instant access', 'includes dentist', or potentially 'pre-existing condition coverage' (if this is something they can offer).

In our last report, we noted that Sovereign Healthcare are ranking for very few longtail keywords. This remains true in Q3, with Sovereign ranking for only 1,013 long tail keywords in total, with only 28 in the top three positions. Sovereign should be working to identify valuable keywords already sitting within their rankings, in addition to identifying further, profitable phrases that have high-purchase intent.

Facebook Adverts

With the number of Facebook users in the United Kingdom (UK) forecast to hit over 42 million users by 2022, it is not surprising that companies have jumped at the opportunity to advertise on the social media platform. Facebook’s UK digital advertising revenue has been estimated to have breached 2.6b GB pounds in 2019.

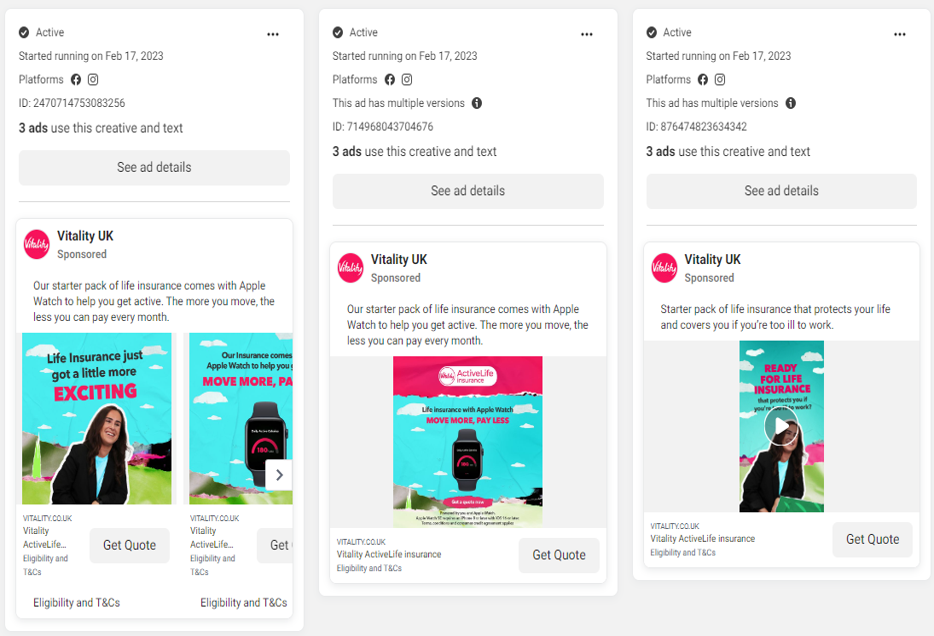

Below, we can see examples of Vitality’s Facebook ads from both this quarter, and our last report. Vitality have opted for a cleaner approach to their creative this quarter, with longer ad copy to go with it. As this is quite a departure from their previous approach, Vitality will be able to get clear data and results that indicate the best style for their audience.

Vitality UK Facebook Ads, February 2023 -

Vitality UK Facebook Ads, July 2023 -

Top Social Shares & Content

When it comes to social media and on-site content strategies, it is important to release content that has a longer shelf life. An article is considered 'Evergreen' if it has maintained its relevancy to an audience for longer. It's great for your retailer engagement, but great for Google too, who will recognise content which achieves traffic over a long period of time. Health insurance providers can look to create content across the full breadth of health and lifestyle, a sector where content is widely shared as users turn to online sources to guide changes in eating, exercise, and other lifestyle habits.

Most health insurance providers have opted for Meta as their most-used social platform. Simply Health have secured the most Facebook likes, with 140,100, while Vitality have the most Instagram followers, with 58,200. Health insurance providers should consider turning to Pinterest for sharing content, a platform with a comparatively more affluent audience that may be more inclined to sign up to a health insurance plan.

Website Readability & Accessibility

20% of people in the UK have a disability – 2 million of which are people living with sight loss. In addition, 1 in 12 men and 1 in 200 women have some degree of colour vision deficiency. When websites are not designed to meet these needs, brands lose customer interest as they turn elsewhere. Any website operating in the healthcare space must be particularly conscious of accessibility, from both a branding and potential customer perspective.

In our last report, we noted that Spire Healthcare were seeing the highest volume of contrast errors, with a total of 212. In Q3, Spire Healthcare have reduced this down to just 44. The health insurance providers who should now be most concerned about their accessibility are Westfield Health and Nuffield Health, who have been flagged with 163 alerts each.

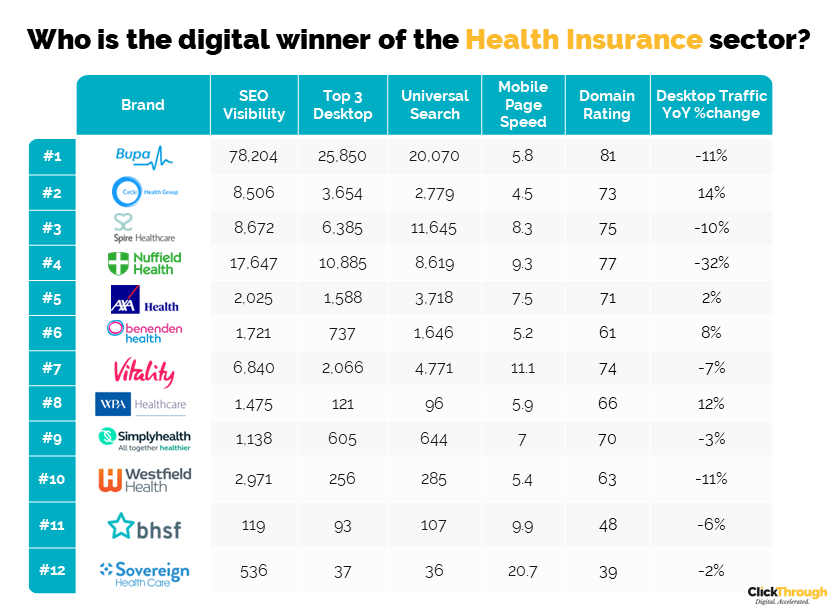

Q3 2023 WINNERS LEADERBOARD

For a glance into just 6 of the metrics we evaluated these top 12 health insurance providers on, check out our quick-look table below;

GET THE FULL 79-PAGE Q3 2023 REPORT

To get a copy of the full report, please complete the enquiry form. If you want to talk to us about accelerating your digital performance, please call us on 01543 410014 or schedule a call with Mike Movassaghi.

Photo by Marek Studzinski on Unsplash

Let's be social

Join our growing social communities to learn more about the benefits of digital marketing and the people who make us tick.