The Q4 2023 benchmarking report for UK high-street banks has just been published. Learn how the top 12 UK high-street banks perform across the digital space.

The latest Q4 2023 benchmarking report for UK high-street banks has just been published. It covers the largest 12 national high-street banks, including Lloyds, NatWest, Barclays, Royal Bank of Scotland, HSBC, Metro, Santander, TSB, The Co-operative Bank, Virgin Money, Yorkshire Bank, and Clydesdale.

The research gives an inside track on who is winning the biggest share of voice online, and quantifies the gaps, risks and missed opportunities for other high-street banks to win brand exposure, drive online visits, and generate in-branch footfall. The report highlights quick wins that will improve enquiries from your online strategy and identifies the barriers that may be reducing your site’s ability to optimise digital performance.

To see a preview and contents page of the Q4 report, click here. To get a copy of the full report and the key takeaways, please complete the enquiry form or schedule a call.

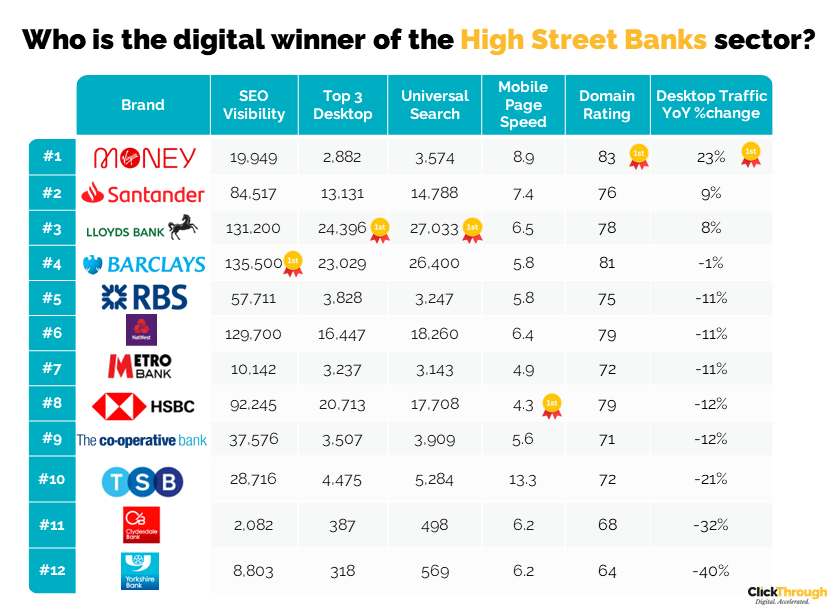

Q4 2023 WINNERS LEADERBOARD

For a glance into just 6 of the metrics, we evaluated these top 12 high-street banks on, check out our quick-look table below;

Continue reading for further detail on this quarter's best and poorest-performing brands, or request a copy of the report for the full review.

What The Industry Research Report Covers

The 70+ pages of research benchmarks each brand based on 50+ metrics and indicators of successful digital strategy, including organic visibility, domain authority, paid media ads, conversion performance, technical performance, site speed, universal search, content, social ads, accessibility, and mobile performance.

Driving Optimal ROAS from Paid Media Channels

Some of the leading players in the space are high spenders on paid media channels such as Google, Bing & Facebook - but have a poor or sub-optimal conversion improvement strategy. Without an optimised, sophisticated conversion strategy that maximises the conversion rate, the return on investment is unsustainable or will underperform. Scaling spend on paid media is not achievable unless the conversion rate delivers optimal performance in the sector. Some in the space have paid media spend levels from 30k+ per month but dedicate minimal resources and budgets to conversion testing. Given the cost per clicks on ad networks will continue to rise, we recommend spending at least 10% of your paid media budget on ongoing conversion optimisation testing schedules to ensure your paid media ROI maintains long-term viability, competitive advantage, and sustainability.

Technical Website Compliance

Savvy digital marketers know that having a technically sound website is an essential component of a successful fully integrated digital strategy - plus a site capable of maximising conversion performance. Bank customers need to trust their providers to give an excellent level of service and a site full of dead ends due to 4xx errors is likely to reduce consumer confidence.

UK high-street banks generally have few 4xx or 5xx errors, with most banks returning less than 100 in our crawls (though this should ideally be as low a figure as possible). In our last report, we noted that Santander was seeing the highest level of 4xx errors returned, with 296. In Q4, Santander has increased this figure to 374. Santander must ensure that key pages are not being blocked by digital dead ends.

Site Speed & Conversion Rate Performance

When 62% of consumers are less likely to convert if they have a negative mobile site experience, ensuring that your site is quick and easy to load makes a significant improvement on your overall conversion rates. As with ensuring sites are technically compliant, banks can improve consumer confidence by providing a quick, seamless experience through mobile page speed.

In our last report, mobile page speed scores ranged from 58 down to 8, following universal falls in mobile page speed performance. In Q4, these scores ranged from 61 (for Santander) to 11 (for HSBC). Santander and Virgin Money are currently the only banks surpassing the 'okay' benchmark of 50.

Building Competitive Advantage with Domain Authority

Domain authority is an essential metric for measuring the effectiveness of SEO performance and helps create a reliable overall gauge of how effective your site is at achieving organic traffic, i.e. ‘free’ traffic that isn’t gained through sponsored ads. High-street banks can build their DA by sharing information about money-saving techniques, demographic studies of spending, and guides on different financial products.

A ‘good’ DA really comes down to how your competitors are performing however, it’s generally considered average between 40 and 50, good between 50 and 60, and excellent above 60. In our last report, DAs for high-street banks ranged from 84, down to 64. There has been little movement since, with scores in Q4 ranging from 83 to 64. Though Yorkshire Bank is still the lowest-scoring high-street bank when it comes to DA, a score of 64 remains excellent and is a great indication of trust and authority.

Organic Performance – Mobile & Desktop

A strong organic performance is strategically important as it ensures your site ranks above competitors for key, transactional keywords. When 93% of your customers won’t go past the first page of Google, your absence or lack of targeting for essential keywords will cost you conversions. High-street banks may see increased traffic from account holders shopping around for better interest rates, or to find better deals on credit cards and loan options during the cost of living crisis.

As in our last report, three banks have seen an increase in organic traffic year on year. Lloyds Bank and Santander have maintained growth in digital footfall, while Metro has replaced Virgin Money as the third bank seeing an increase. The biggest loss in Q4 has come from Royal Bank of Scotland, which has seen a 93% loss compared to 2022.

Universal Search Opportunity

Google Universal Search Results is an evolving opportunity to make your pages visible on a SERP (Search Engine Results Page). Universal results often appear before traditional listings and are eye-catching for users. Universal search results refer to rankings on a SERP that are not the traditional ‘blue line’ Google link, and a site can appear for universal search results without being strong in standard rankings. 'Local pack' could prove to be a beneficial Universal Search result for high-street banks to generate in-branch footfall, while 'people also ask' results provides an opportunity for banks to share information about key products.

'People also ask' remains the most-used Universal Search result. Lloyds has maintained the lead on these resutls, with 20,400 recent appearances. A strong performance for 'people also ask' results usually indicates a good approach to longtail keyword strategy, a chance to rank for high conversion-potential terms.

The Longtail Keyword Opportunity

Longtail keywords are often considered high intent and potentially more likely to convert as a searcher is being more specific. Optimising for longtail keywords also puts your content strategy in a strong position to rank for brand new search terms as they enter Google’s index. Banks will want to ensure their longtail keyword strategy includes topical terms and questions that are likely to gain visitors, such as queries surrounding mortgage renewals,

While Lloyds Bank ranks for fewer longtail keywords than Barclays overall, Lloyds is still securing more appearances within the top three, ten, and twenty results. Though Barclays may have a much broader longtail keyword strategy, Lloyds' appearances for higher positions suggests better, more powerful content that is appealing for these high-conversion terms.

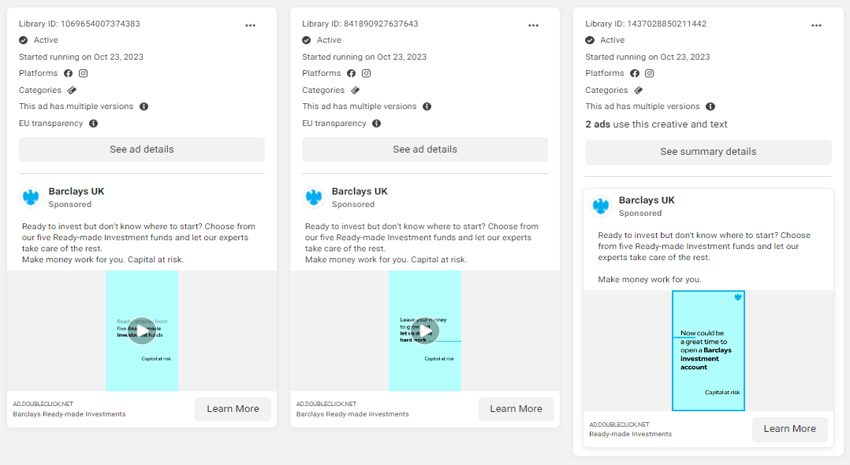

Facebook Adverts

With the number of Facebook users in the United Kingdom (UK) forecast to hit over 42 million users by 2022, it is not surprising that companies have jumped at the opportunity to advertise on the social media platform. Facebook’s UK digital advertising revenue has been estimated to have breached 2.6b GB pounds in 2019.

In Q4, we have only found live Facebook ads for Barclays. Barclays has used vertical-format videos to occupy as much screen real estate as possible, with video creatives sitting seamlessly into native 'Reels' content. The use of the same copy across multiple ads enables Barclays to assess performance based on visual creative alone, allowing for tighter strategy in future campaigns.

Top Social Shares & Content

When it comes to social media and on-site content strategies, it is important to release content that has a longer shelf life. An article is considered 'Evergreen' if it has maintained its relevancy to an audience for longer. It's great for your brand engagement, but great for Google too, who will recognise content which achieves traffic over a long period of time. As with improving DA and generating backlinks, high-street banks can create informative, engaging content that educates social media users about different financial products. However, as seen in Virgin's Facebook ads, social media is also an opportunity to have fun with their brand, and secure engagement from non-money focussed content.

Facebook is the platform of choice for almost all high-street banks. HSBC has, by far, won the largest audience on social media, with a total of 3.1 million Facebook likes. This represents a huge audience that are readily connected with the brand and more likely to see content as and when it is posted.

Website Readability & Accessibility

20% of people in the UK have a disability – 2 million of which are people living with sight loss. In addition, 1 in 12 men and 1 in 200 women have some degree of colour vision deficiency. When websites are not designed to meet these needs, brands lose customer interest as they turn elsewhere. As banking is a universal need, high-street banks must ensure they're able to serve a site that is easy to navigate and trust in to anyone with a vision deficiency.

In our last report we noted that Yorkshire Bank and Clydesdale Bank were the least accessible sites in our report, with 103 alerts each. While neither bank has seen any improvements in Q4, TSB is now also recording 102 alerts. These banks must address these accessibility concerns to accommodate all customers using their service.

GET THE FULL 79-PAGE Q4 2023 REPORT

To get a copy of the full report, please complete the enquiry form. If you want to talk to us about accelerating your digital performance, please call us on 01543 410014 or schedule a call with Mike Movassaghi.

Photo by Etienne Martin on Unsplash

Let's be social

Join our growing social communities to learn more about the benefits of digital marketing and the people who make us tick.