We've already reviewed top construction retailers mobile user experience, but how much traffic are these brands getting? We review the current state of play for mobile search traffic in the sector.

Rob Allen - Home Improvement Specialist

In our series on home improvement brands, we’ve already looked at why DIY and construction businesses are performing poorly on mobile site speed, and why this is important to combat. However, while ensuring customers have a positive on-site experience with your brand is essential to drive conversions, so is getting site visitors in the first place!

Which construction retailers have the best organic visibility?

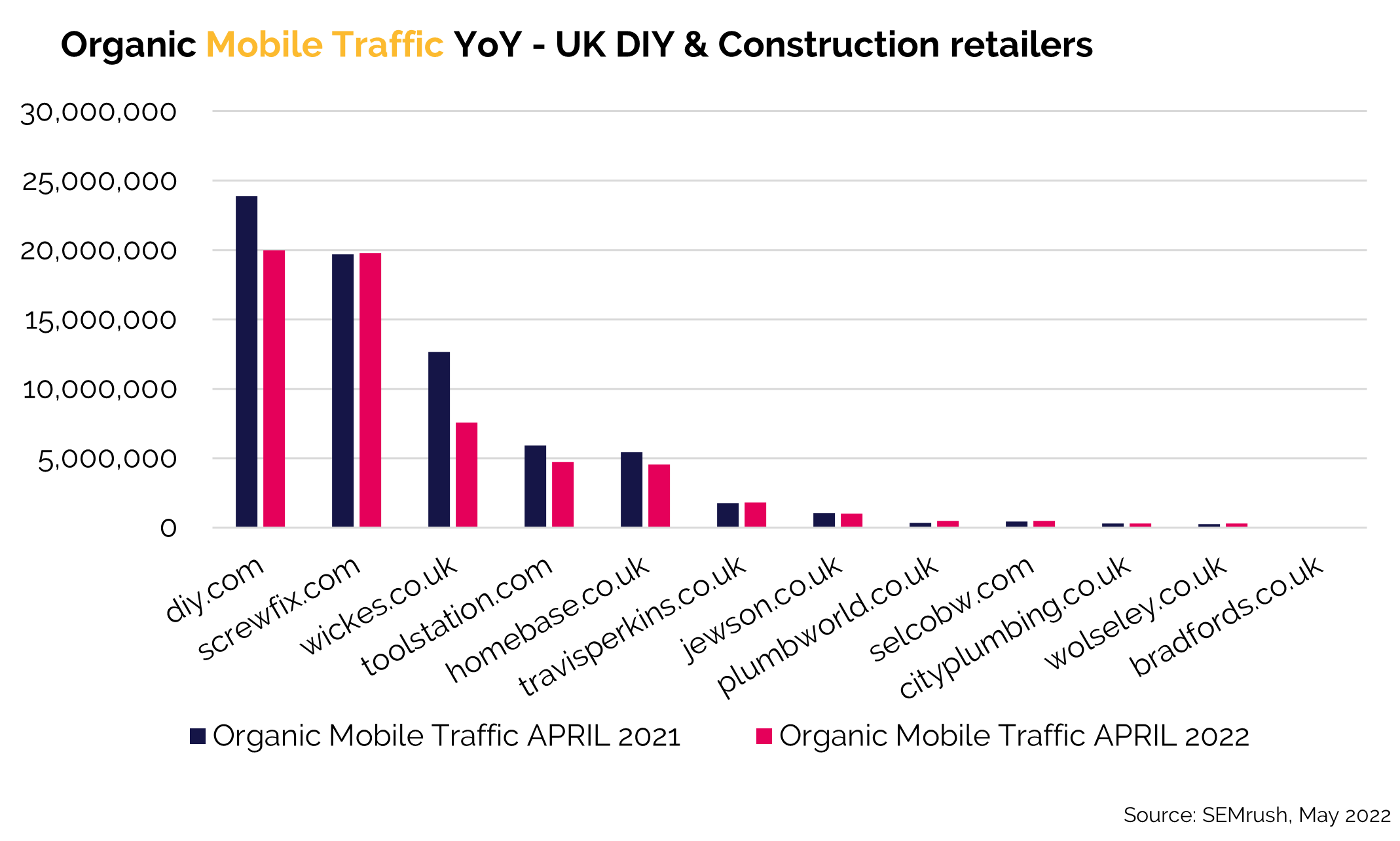

In our report, we saw an overall fall in mobile traffic in the sector, year on year. With interest in home improvement falling slightly due to the cost-of-living crisis, this is likely to reflect user buying habits rather than the performance of these brands themselves. However, among this sector-wide fall in traffic, some brands have maintained similar levels of visibility, or even increased their total traffic.

Interestingly, when we look to the lower end of the scale of total organic traffic, brands have either maintained visitors, or even significantly increased their figures, such as Bradfords (+52% YoY), Plumbworld (+50% YoY), and Wolseley (+22% YoY). Though this doesn’t account for the total lost traffic, it indicates these brands are working harder on their organic digital performance in order to poach some of the limited traffic from the competition.

The biggest loser when it comes to YoY traffic loss is Wickes, who have seen a fall of 40% in their organic mobile traffic. With Screwfix maintaining performance, and DIY.com seeing a smaller reduction of -16%, this should be concerning for the well-known brand.

How these 12 brands score on organic mobile traffic YoY:

- DIY.com - -16%

- Screwfix – 0%

- Wickes - -40%

- Toolstation - -20%

- Homebase - -16%

- Travis Perkins – 4%

- Jewson - -2%

- Plumbworld – 50%

- Selco Builders Warehouse – 6%

- City Plumbing – 3%

- Wolseley – 22%

- Bradfords – 52%

What can DIY & Construction brands do to improve visibility?

With an overall fall in traffic, it’s fair to say that any brands who have minimised their traffic loss, or even maintained similar YoY levels is doing well in this sector. The question will be, how can DIY & construction brands maximise their visibility to a shrinking user base?

While mobile page speed is a contributing factor to visibility scores, there are a number of other impacting elements to this metric when we look at organic performance. Among other things, to ensure that their business is becoming more visible to mobile users, DIY & construction brands should be looking at;

- Improving their likelihood of appearing in universal search results,

- Ensuring their product pages are optimised for high-potential keywords,

- Enhancing their site’s accessibility and wider technical issues.

In addition, construction and DIY brands should take particular care of their local SEO and presence for ‘near me’ searches, to capture traffic and conversions from users who need supplies, fast!

GET THE FULL 70-PAGE Q2 2022 REPORT

To get a copy of the full report, please complete the enquiry form. If you want to talk to us about accelerating your digital performance, please call us on call 01543 410014 or schedule a call with Rob Allen.

Photo by Karl Solano on Unsplash

Let's be social

Join our growing social communities to learn more about the benefits of digital marketing and the people who make us tick.