Who is primed to profit the most from post-pandemic revenge spending? We look at why digital-first fashion brands could be set to come out on top.

Rob Allen, Clothing & Fashion Specialist

Like many industries, growth within the high street fashion sector has stagnated at 4.1% over the past 5 years, with the pandemic, travel restrictions, and store closures damaging overall spending on clothing (and putting the physical high street at risk altogether)!

However, with “revenge spending” following the pandemic, travel back on the cards, and hospitality opening its doors once again, the sector recovered with a 34.3% growth in 21/22, leading to a £36.5bn market valuation.

But which brands are doing the best in this return to the old normal?

How many fashion shoppers are buying online?

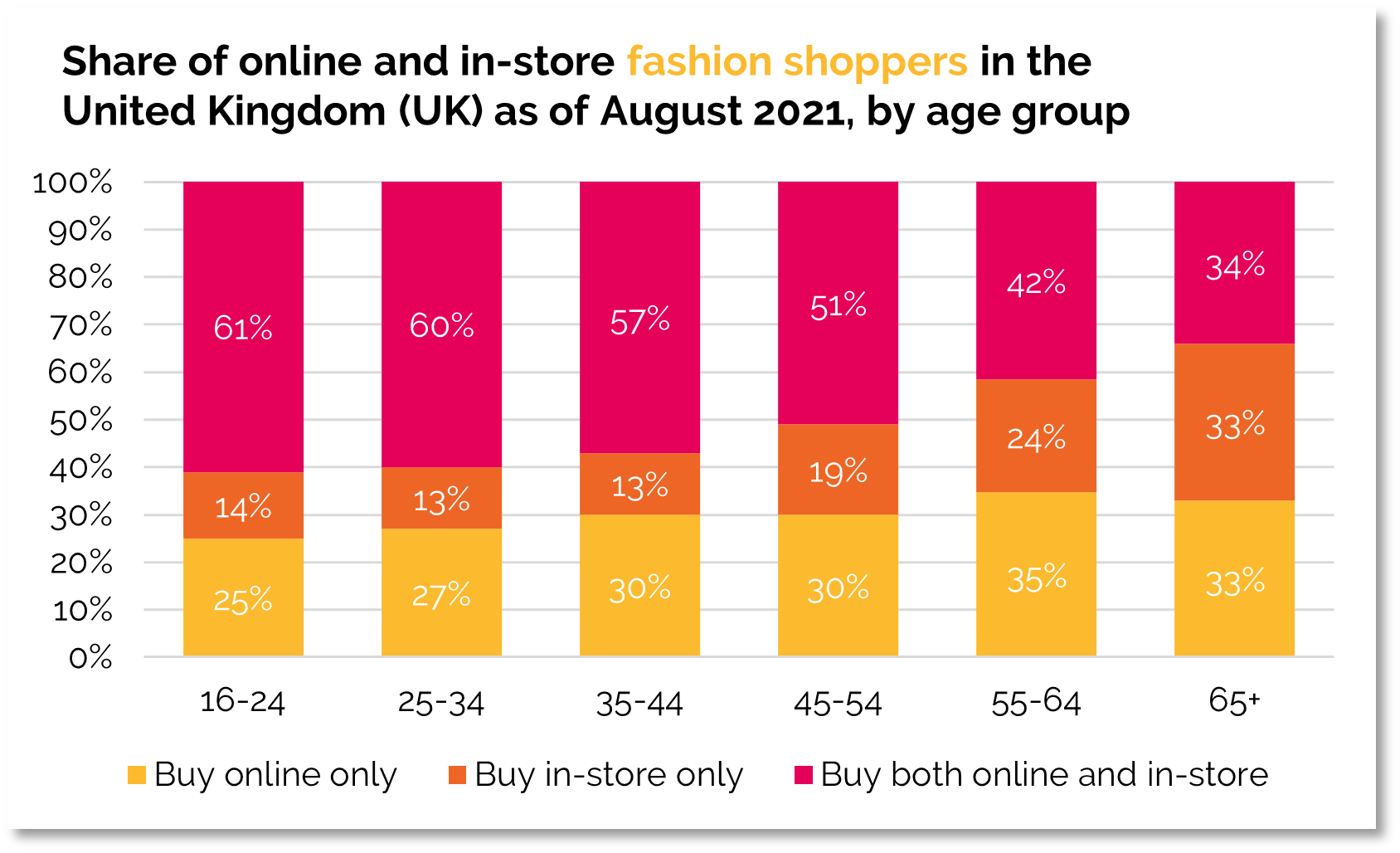

Unsurprisingly, the percentage of shoppers looking either exclusively online or in-store for their fashion purchases varies throughout age groups.

Source: Klarna; Savanta; TheIndustry.fashion via Statsista

Source: Klarna; Savanta; TheIndustry.fashion via Statsista

While the amount of those who make their fashion purchases online exclusively stays relatively stable across all age groups, ranging between 25-35%, the amount of those who only want to spend in-store increases with age. Only 14% of 16-25-year-olds will exclusively buy clothes in-store (with 61% buying both online and in-store), though this rises steadily to 33% at age 65+, with an additional 34% buying both online and in-store. Though brands can expect online customers of all ages, those catering to older age groups must be able to effectively advertise through non-digital means, or else risk losing up to a third of their customer base.

Of these online customers, 60% of transactions were placed via a mobile, rather than desktop, meaning that a fast mobile site is essential for driving conversions.

Downward Pricing Pressure

For high street fashion retailers, downward pricing pressures and a race to offer the best value for money are challenging profit margins and meeting increasing expectations to be sustainable.

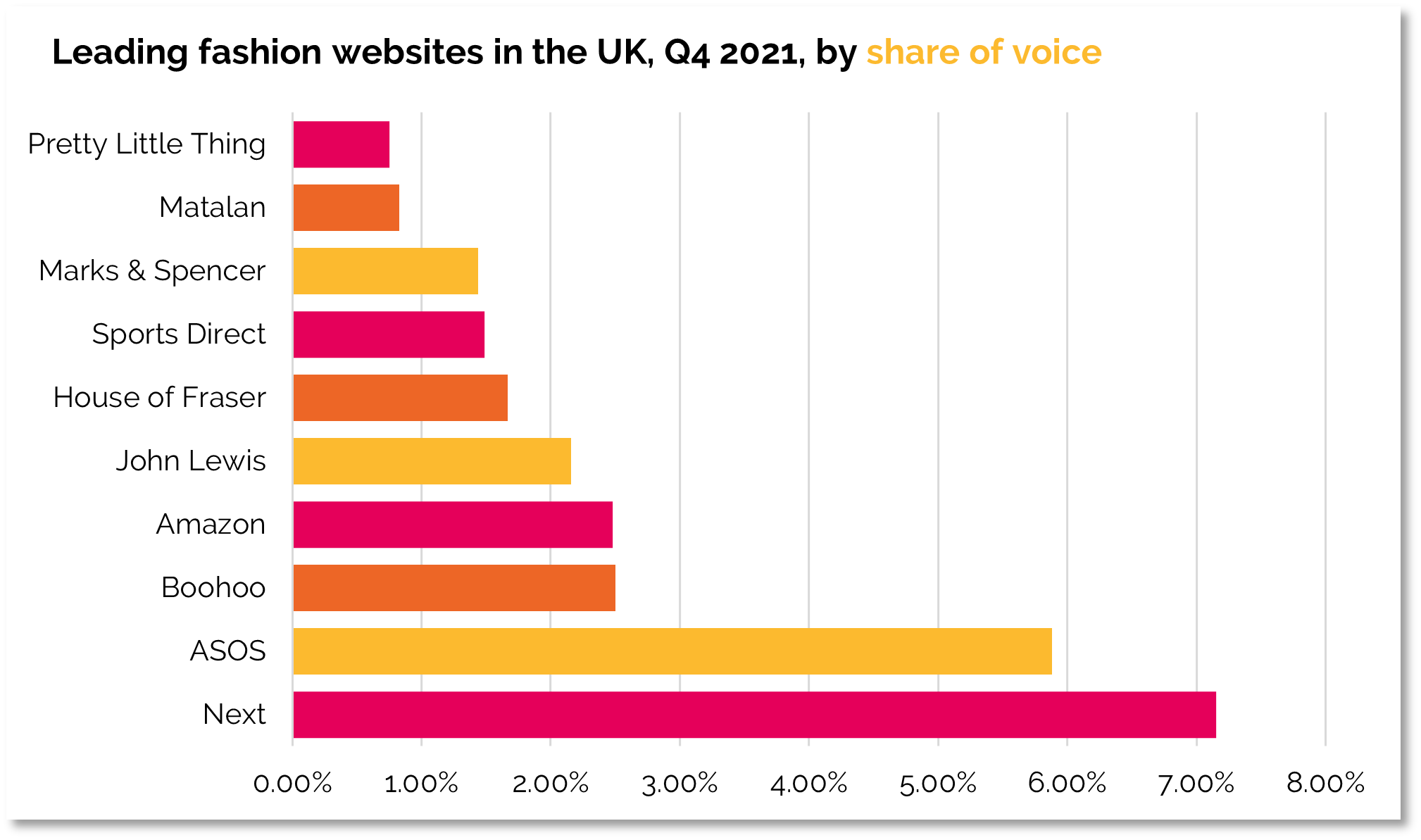

With fashion becoming increasingly digital-first, online-only fast fashion retail has created challenging operating conditions. Online retailers such as Pretty Little Thing, ASOS, and BooHoo have long had a digital-first approach to their overall strategy, helping them easily commandeer large organic shares of voice for the entire fashion sector, among more premium retailers such as Marks and Spencer’s, John Lewis, and House of Fraser.

Source: Pi Datametrics, via Statista

Source: Pi Datametrics, via Statista

With no physical retail spaces, they were unaffected by the store closure aspect of lockdown and were not forced to maintain overheads for physical locations that were not actively driving profits. This helps digital-first brands to offer attractive deals, vast product ranges, and a convenient shopping experience. With Pretty Little Thing, ASOS, and Boohoo each offering a ‘premier’ delivery service (next day delivery for a full year at a cost of around £10), they are able to attract customers by being both affordable and convenient.

But fast fashion brands must be wary. Though they have enjoyed growth over lockdown, and in the return of social events, changing consumer attitudes are putting them at risk. Though unable to offer attractive delivery options, second-hand apps are quickly overtaking fast fashion within the digital-first space, and have even fewer overheads than online-only new fashion brands due to not needing to rent warehouse space. Apps such as Depop, Shpock, and Vinted offer seamless shopping experiences with even lower pricing than the likes of Boohoo and Missguided, making them attractive to consumers on both a financial and environmental level.

Men’s fashion sees the highest potential growth

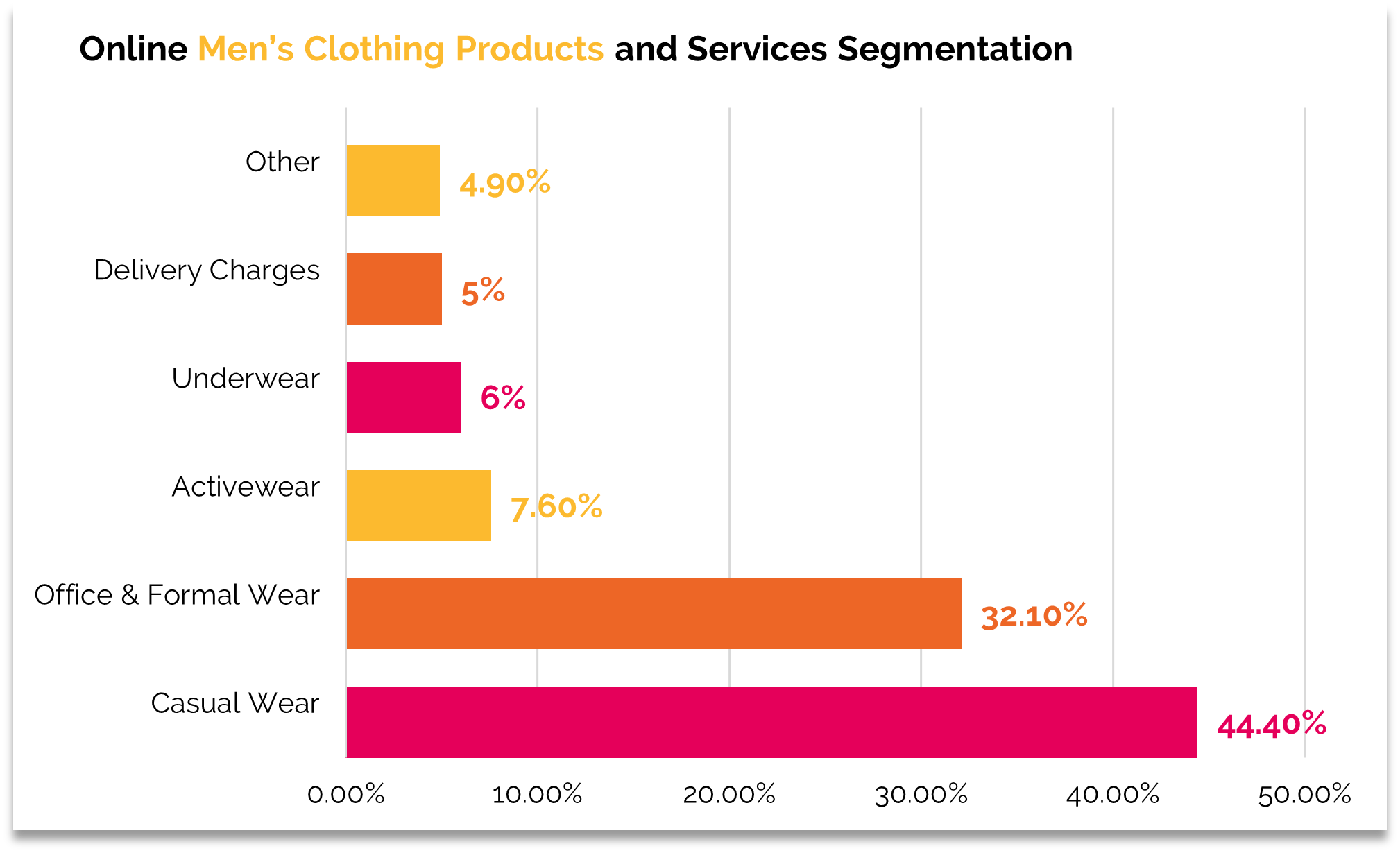

Though women’s fashion remains the highest revenue driver across the mainstream fashion industry, accounting for £11.5bn of annual spending on clothing and 50% of the overall sector, men’s fashion represents the highest growth category within the sector with revenue set to grow at 8.4% to deliver £2.9billion of revenue in 2022, particularly in casual wear which makes up 44.4% of Men’s clothing products.

Source: IBISWorld, Online Men’s Clothing Retailing in the UK/IPA Insight Centre, December 2021

Source: IBISWorld, Online Men’s Clothing Retailing in the UK/IPA Insight Centre, December 2021

Additionally, research from ONS suggests that men are more likely to exclusively shop online, emphasising the need for brands to have a strong digital strategy in order to be a key player in this space. Though far from a newly emerging subcategory, men’s clothing brands should be putting themselves in prime position to compete with rivals in the space during this time of rapid growth, and ought to be investing in digital strategy to ensure solid visibility.

Alternatively, brands that serve both men and women and traditionally focus on their women’s clothing lines might want to consider increasing or reallocating some budget towards any high-yielding men’s clothing campaigns they are currently running, ensuring they can stay ahead of the game in this growing sector.

GET THE FULL 70-PAGE Q2 2022 REPORT

To get a copy of the full report, please complete the enquiry form. If you want to talk to us about accelerating your digital performance, please call us on call 01543 410014 or schedule a call with Rob Allen.

Let's be social

Join our growing social communities to learn more about the benefits of digital marketing and the people who make us tick.