How much is the organic traffic of Office, Schuh, and Clarks really worth? We take a look at what the online visibility of these three footwear giants means for their brands.

Rory Tarplee, SEO Specialist

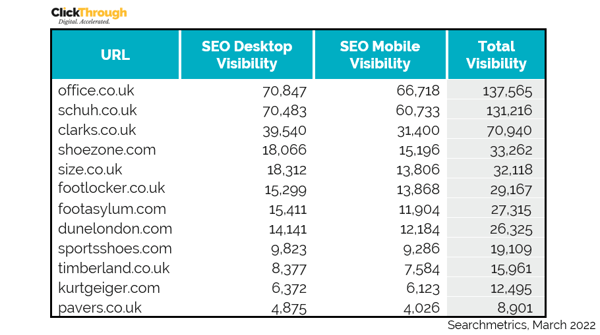

In our recent competitor intelligence report into the 12 leading shoes and footwear brands, we spotted that Office were leading the pack when it came to their combined Desktop and Mobile visibility.

But, when it comes to translating organic performance into revenue, which of these brands was really ahead?

Why might Office’s search volume be skewed?

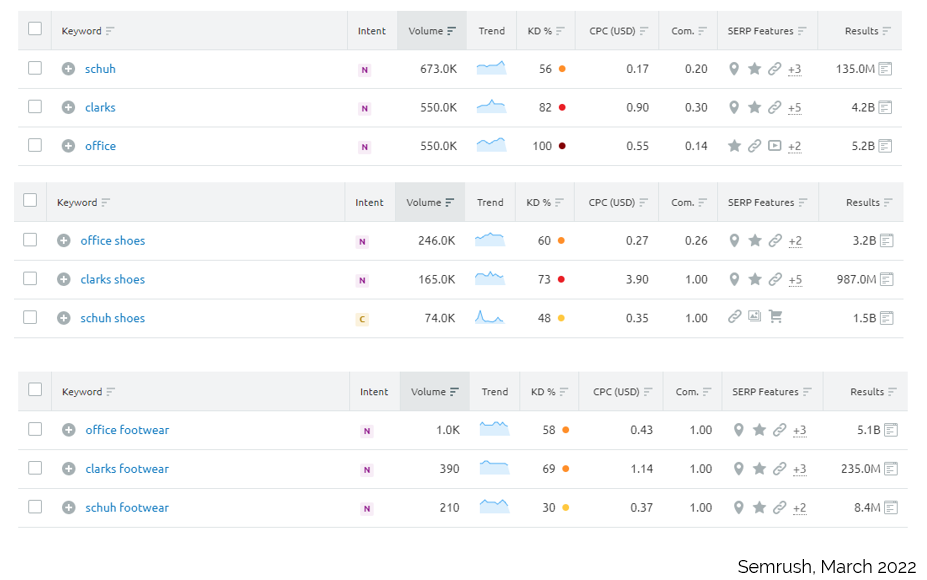

While, on the face of it, ‘office’ itself has a high search volume (550,000), along with ‘office shoes’ (246,000) or ‘office footwear’ (1,000), we need to consider that these are also generic terms (further indicated by ‘office’s keyword difficulty rating of 100%).

Office holding a generic term as a brand name distorts the Searchmetrics visibility data that normally gives a fair indication of organic success. We have to consider when looking at Office’s visibility that;

- High search volumes don’t indicate a high level of interest in the brand.

- These ‘office’ based keywords can be optimised for by competitors.

To properly assess brand interest and organic performance, we need to appreciate that performance may be bloated by users looking for work-friendly footwear rather than the brand itself.

What is the best way to measure organic performance?

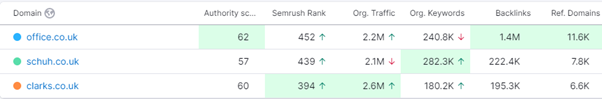

When we look at SEMrush rank between Office, Clarks, and Schuh, we get a broader picture of how these top three footwear brands are comparing against one another and who is storming ahead in these different areas.

Office have achieved the highest authority score of 62, with a huge 1.4m backlinks from 11.6k referring domains. However, they’re only two authority points ahead of Clarks, who have a significantly smaller backlink profile. It may be a case of quantity over quality, or a poorly maintained historic profile, this means this vast profile is only giving them a slight edge against the competition.

Schuh are ranking for the most keywords of the three, achieving rankings for 282,300 keywords – over 100,000 more than Clarks. With a range of brands on offer, both Schuh and Office have the benefit of being able to create optimised content for both generic footwear terms and branded terms from leading footwear brands.

Despite this, Clarks are achieving the most organic traffic, at 2.6m visits per month. They’re also winning on the SEMrush ranking front, coming in at 40 places higher than their nearest competitor, Schuh. When the goal of organic optimisation is to drive traffic to your site, it’s hard to argue against Clarks being the strongest performer.

Why are Clarks getting more traffic from fewer keywords?

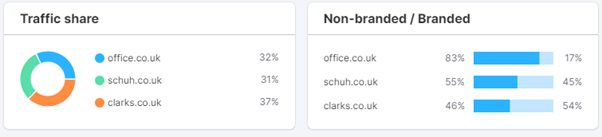

When we assess performance of branded versus non branded keywords, the difference in performance is stark.

Clarks achieve the biggest proportion of branded traffic, which accounts for 54% of their total visitors, however, they still receive 46% of their traffic from non-branded terms. As a retailer that doesn’t stock other brands, we can assume they have strong visibility on extremely generic terms, such as ‘women’s black boots’ or ‘school shoes’.

While non-branded terms bring in 55% of Schuh’s traffic, we have to consider that many of these terms will be for other footwear brands. There will be increased competition for these keywords and product lines – both in terms of SEO and what offers and prices are available.

Office rely on non-branded keywords to bring in 83% of their traffic. While they’ll be relevant to Office’s products, there will be tough competition with other online retailers (such as Schuh) also selling the stock, meaning Office must work significantly harder at optimising for these terms.

What is the true value of Clarks’ traffic?

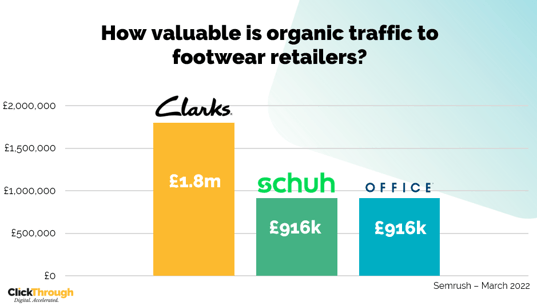

We can’t know exactly how much revenue these brands are achieving from organic traffic, but with Semrush's help we can identify the value of this traffic in PPC terms to establish 'the estimated monthly cost to rank for keywords in Google Ads'.

While they may not rank for the same volume of keywords as Schuh or Office, Clarks achieving organic traffic worth £1.8m per month (double both Schuh and Office’s worth of £916k) makes it clear that they are optimising for the highest-value keywords.

For Schuh and Office to close this gap, it represents a significant investment in either PPC advertising or a stronger organic strategy.

Clarks’ clearly have a strong strategy for optimising on profitable keywords that will achieve them sales. With a site size of 5,600 pages, compared to Office’s 40,400 and Schuh’s 19,500, we can safely assume that Clarks have a targeted approach to support a well-maintained site with a smaller product selection.

So, how can Office and Schuh improve their organic traffic value?

- Make their sites easily crawlable and assess where keywords may be getting cannibalised.

- Identify their most profitable lines and build up their keyword strategy around these products.

- And, for Office, assess how user behaviour and search intent around terms such as ‘office shoes’ should influence how to optimise for brand terms.

GET THE FULL 70-PAGE Q2 2022 REPORT

To get a copy of the full report, please complete the enquiry form. If you want to talk to us about accelerating your digital performance, please call us on call 01543 410014 or schedule a call with Phil Robinson.

Let's be social

Join our growing social communities to learn more about the benefits of digital marketing and the people who make us tick.