How can outdoor clothing brands take their specialist sales skills online? We look at why this move to digital is so important for this sector.

Rob Allen, Clothing & Fashion Specialist

We already know that lockdown and the Covid-19 pandemic contributed to a boom in athletic footwear sales. With outdoor activities being one of the few opportunities to leave the house, and later socialise, profits for athletic footwear and clothing grew during lockdown, while other fashion sectors struggled to maintain.

In the case of outdoor clothing brands, they were presented with a niche opportunity to grow interest in their ranges. With outdoor activities such as walking becoming more popular among those looking to improve their fitness during lockdown, brands should have been able to market their products to a newly interested audience. Over the five years through 2026-27, industry revenue is forecast to increase at a compound annual rate of 1.6%, to reach £10.2 billion.

However, the diversity within the Outdoor Clothing and Leisure sector has made this trend far from universal. In the short term, inflationary effects of high demand and struggling supply is anticipated to constrain profit margins, with downward pricing pressures placing strain on specialist retailers.

Entry-level items accessible for all

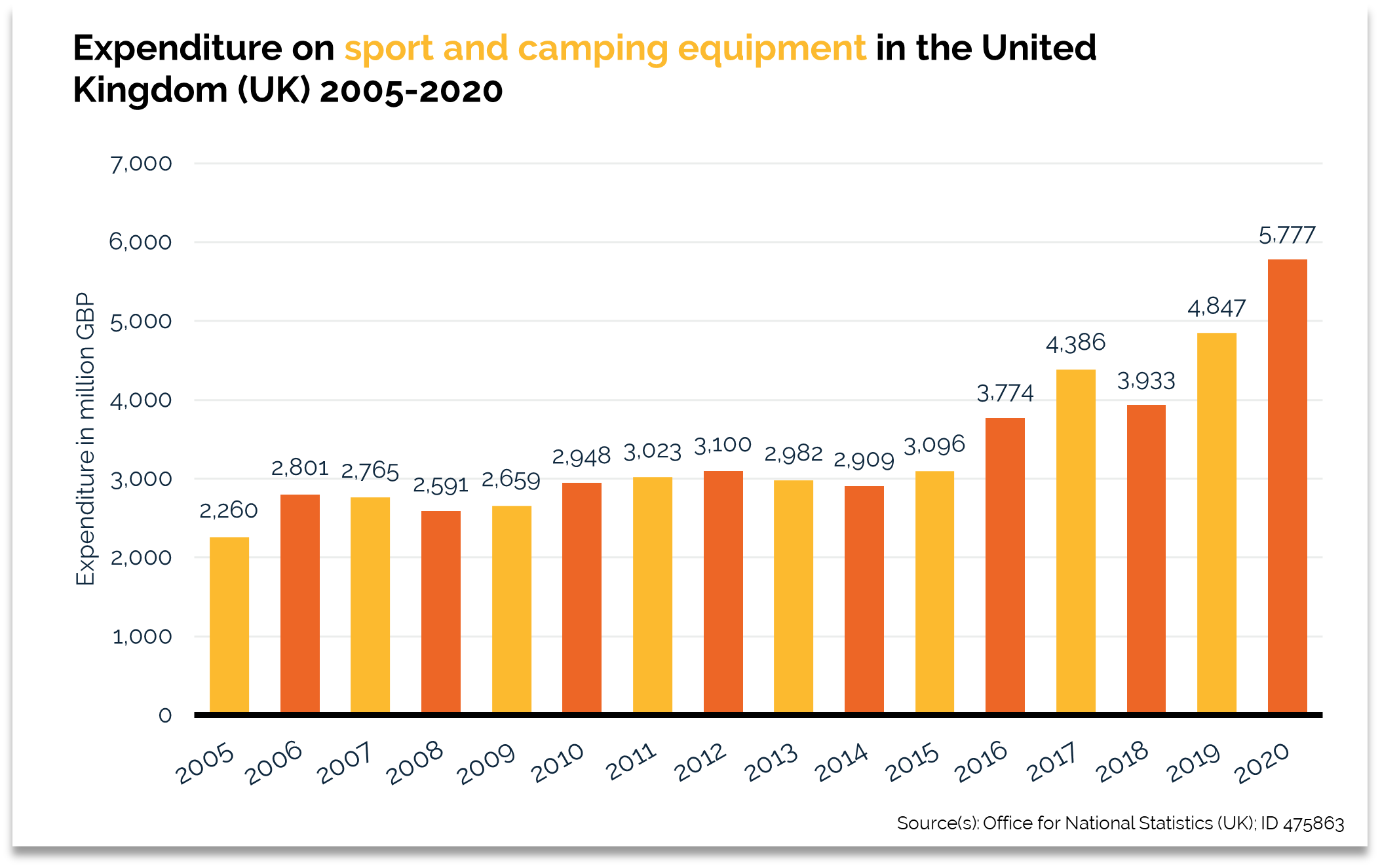

Brands such as Go Outdoors, Trespass, and Blacks were able to benefit from increased enthusiasm in outdoor & leisure pursuits, as they offer a wide range of accessible clothing & equipment at both low and high price points. While consumer spend on outdoor services fell by 33% between 2019 and 2020, spend on outdoor equipment increased by 20% in the same period (Statista, Outdoor recreation market in the United Kingdom [UK], 2022);

For brands which are both highly visible online and stock options for casual outdoor enthusiasts, this was a profitable time.

Specialist brands suffer from lack of travel

But, for more specialist clothing and outdoor equipment retailers, a boom in domestic outdoor pursuits only goes part way to boosting sales. Brands catering to alpine pursuits, such as Snow and Rock, and Ellis Brigham, rely on travel to specialist regions that facilitate these activities. As specialist brands’ product lines cater to enthusiasts in outdoor pursuits, and therefore would not be considered ‘entry level’ when we consider price points, they therefore rely on serious hobbyists being able to partake in their recreational activities, and needing to buy new clothing.

While, during lockdown, travel outside of your immediate area wasn’t permitted (meaning any alpinist activities were limited to those who lived in the limited mountainous regions in the UK), it is now a slow return to international travel which limits these brands’ options, coupled with (if not amplified by) the cost-of-living crisis turning shoppers off more extravagant purchases or holidays abroad.

Return to Retail – Supply and Staffing

Outdoor clothing retailers are (like many other industries) currently facing supply and demand issues resulting from hold ups within the global supply chain. Though, unlike for fast fashion brands, outdoor clothing retailers are not as time-constrained by fast moving trends, they do need to be able to offer a satisfying range of products and stock to maintain customers and not lose them to competitors.

Additionally, staffing shortages, which have partly come from tighter immigration laws in the UK following Brexit, have impacted the availability of staff with specialist knowledge to work within stores. When it comes to specialist equipment, being able to engage with an expert at the point of sale ensures customers are making a knowledgeable choice and purchasing an item that will suit their needs. Granted, this may be seen as an opportunity for salespeople to upsell, but brands within leisure retail spaces, such as outdoor clothing, rely on being seen as specialists in order to;

- Build credibility among hobbyists, athletes, and influencers,

- Ensure customers are satisfied and will return for future purchases,

- Be seen as a reputable brand within professional publications within the sector.

Outdoor clothing retailers must now focus on how they can replicate that shopping experience digitally, and ensure customers are not simply filtering price from lowest to highest when browsing.

Even with bricks and mortar stores reopening, internet sales accounted for 27.9% of retail sales in 2020 (compared with 14.7% in 2016 – Office for National Statistics), digital performance can not be taken for granted. The question remains – how can retailers convey this specialist knowledge that comes from engaging conversions to online shoppers?

Bringing outdoor pursuits online

Brands may need to look to technical developments to replicate the buying experience usually found in store.

Omnichannel shopping experiences can help immerse consumers into a brand and replicate the in-store shopping experience. This is commonly seen in luxury brands within Asian markets, but could be applied as a way to immerse shoppers within a brand experience and mimic the carefully crafted experience bricks and mortar stores have been designed to provide.

As virtual reality emerges as a potential advertising stream, outdoor clothing retailers may benefit from offering virtual experiences that demonstrate clothing and equipment. Though the challenge with clothing may be the lack of ability to touch and feel, this could be an engaging way to demonstrate tools and accessories within a (simulated) outdoor environment.

Augmented reality can act as a steppingstone to virtual reality, giving shoppers an opportunity to roughly test clothing sizes and styles before committing to purchase. With clothing designed for comfort, facilitating an easy try-on process online helps brands minimise returns and provides a positive experience.

Despite outdoor pursuits being one of the few activities allowed within lockdown, brands have experienced varying benefits from new hobbyists or changing spending habits. For brands offering a broad range of products and price points, they have been able to position themselves as an accessible entry-level choice, whereas more specialist retailers face being hit by the cost-of-living crisis.

GET THE FULL 70-PAGE Q2 2022 REPORT

To get a copy of the full report, please complete the enquiry form. If you want to talk to us about accelerating your digital performance, please call us on call 01543 410014 or schedule a call with Rob Allen.

Photo by James McKinven on Unsplash

Let's be social

Join our growing social communities to learn more about the benefits of digital marketing and the people who make us tick.