How To Drive Profits Through Untapped Markets During A Recession.

ClickThrough's Head of International, Alison Booth, tells us how to increase your profits through untapped markets during a recession.

Read moreClickThrough's Head of International, Alison Humphries, has combed through the world's newswires to bring together the most important International Marketing stories, including the likelihood of a UK-Australasia trade deal, how to use WeChat in your B2B communications and how China's retail sector is getting back in the groove post-lockdown.

What's new, important and interesting in international marketing? This week we look at the recovery the Chinese retail sector could see post lock down, the importance of moving towards digitalisation exemplified by the air cargo industry, the opportunities offered by a more favourable trade agreement with Australia and New Zealand, key learnings that could arise from a second wave and the effective integration of WeChat into your Chinese B2B Marketing activities.

The gradual emergence from lock down in China heralds a glimmer of hope for China’s retail sector according to eMarketer retail sales have escalated to -7.5% at the end of April from -15.8% in March and -20.5% over January and February. Sales are forecasted to return to growth by H2, but performance for the whole year will be impacted heavily by a weak start to the year. Naturally a second wave would have a huge negative impact on China’s retail sector resurgence. The lack of growth of the global economy will reduce the volume of manufactured goods exported from China significantly.

Current economic forecasts indicate a return to positive growth at 3.5% in 2021 rising to 5.4% in 2022.

Top retail brands are already seeing a brighter outlook with H&M seeing sales plummet by 89% in Q4 19, which has shown magnanimous growth to -23% in March 20. Meanwhile adidas cited growth above its 55% global growth in March.

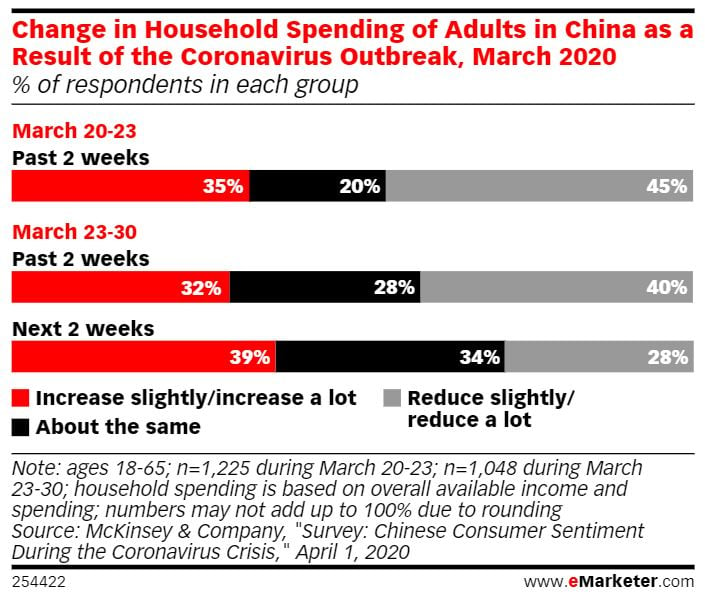

Consumer confidence is returning with a desire to spend tracking slightly higher, as indicated in a March study carried out by McKinsey:

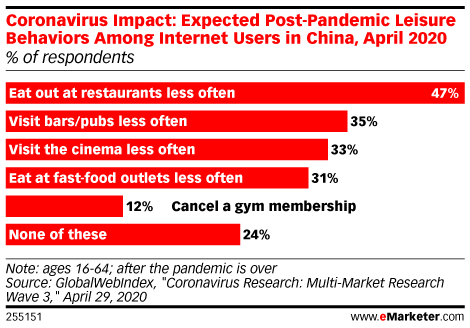

An April GlobalWebIndex survey showed that almost half the respondents would be willing to increase purchases online, but would feel less comfortable with stepping into a brick and mortar location. A significant number of respondents would feel uncomfortable with eating out in restaurants, but would be more inclined to go to the cinema or eat in fast food outlets.

Chinese stores have reopened using a safety first approach through:

Local governments are encouraging people to use digital vouchers supplied through WeChat and Alibaba and Shanghai is planning a shopping festival.

Museums and restaurants are now extending opening hours to extend trading into late evening.

International markets are looking to China to gain an understanding of when a retail sector rebound could be expected, but the fear of a second wave impacts forecasts for this currently.

The Loadstar highlights the importance for the air cargo industry to change business models to digitise. Henk Mulder, head of digital cargo at IATA, outlined that airlines have recently proved their adaptability, but they still rely heavily on physical documentation. The move away from documentation digitised or otherwise to data, is in Henk’s opinion, the path to the future that the industry needs to take. The tech infrastructure is in place for this to happen. The use of data will provide the intelligence needed to aid automation.

Digitisation should not stop with air cargo, the Digital Container Shipping Association (DCSA) emphasised that this is also the future of the shipping industry. Ariaen Zimmerman, head of Cargo iQ, feels that this cannot be achieved through service standardisation, but through the distribution model instead. The industry in interdependent and needs to work together to achieve this.

At a recent IATA meeting, 40% of attendees were continuing with current digitisation plans and 14% had deferred, but were looking to restart. 12% were concentrating on data projects and 22% on increased automation.

Additional market access for UK services and investment is currently under discussion between the UK and the Australian and New Zealand governments to determine how the future of digital trade could evolve, according to The Institute of Export and International Trade

Exported goods and services totalling £21bn traded between the UK, Australia and New Zealand last year. The Drinks and automotive industries and professional services firms are expected to benefit from these trade deals.

The UK is Australia’s 7th largest trading partner, but Australia is the UK’s 19th indicating the gap that could be closed through more favourable trading deals. The key objectives the UK government is striving to achieve through as trade deal with Australia is:

These objectives play favourably into the hands of Scottish Whisky producers, pharmaceutical firms and transport, machinery and automotive manufacturers across the country.

Renegotiating current export deals with New Zealand could in increase UK exports by £100m enabling the set up of an “open advanced economy” to enable the highest “Ease of Doing Business” ranked through The World Bank.

The objectives of the New Zealand deal are to:

This move towards the UK’s growth in involvement with the Comprehensive and Progressive Agreement for Trans-Pacific Partnership will volume of stable export markets for the UK to work with.

Jing address this question through analysing the current situation in Beijing where new cases grew to 106 this week. Results from a survey of 2000 respondents carried out by Morning Consult seeks to gauge customer perceptions of the health risk posed and how this translates to consumer demand and spend trends:

1. Concern regarding health risks are low, but apprehension surrounding the economic impacts of the virus are more notable.

Over 50% of the respondents are concerned about the impact of the virus on their job and finances over the next 6 months.

2. The virus has a fairly wide impact on consumer demand.

Retail suffered a hefty blow with consumers spending less on luxury clothing and beauty products, but healthy food, video streaming services and productions to aid relaxation could see an uplift. Consumers are looking for products and experiences that could relive stress and aid comfort. Reviewing consumer in store experiences and aligning them with these consumer trends could aid success.

3. People are actively seeking products made in China.

The main reasons for this have been the closure of factories where international products are manufactured and the slowdown in delivery times through and post pandemic. The question remains as to whether the heightened desire to buy locally made goods will transcend across different markets post lock down?

4. Outbound tourism remains at a low eb despite the advice to “stay at home” starting to lift.

Only 10% of the respondents were willing to holiday abroad and 74% felt that the US and Europe posed severe health risks of contracting COVID-19.

Key actions brands can adopt to incentivise people to buy are:

Are you keen to incorporate WeChat into your B2B Marketing channels, but are struggling to determine how to do this? Nanjing Marketing Group have proposed some useful starting points:

Produce impactful articles

Chinese consumers are more likely to follow your brand through WeChat than email or another social media platform, as they receive up to 4 articles per month from brands they are following, open rates tend to be higher than platforms like Facebook where posts get lost in Facebook’s algorithmic feed. Share rates average 20% once users open articles, which has an extremely positive impact on brand awareness and engagement rates.

Best practice style guidelines include incorporating:

You will naturally be wondering how you can attract your first 200 WeChat followers:

The answer is simple; share your WeChat account everywhere. People usually start to follow WeChat accounts through scanning a QR code. Effective ways to share this include:

Nanjing Marketing Group do not advocate the use of ads, but instead recommend collaborating with influencers.

Will WeChat QR Codes Replace Business Cards?

Many people scan each other’s WeChat codes to keep in contact. However, it is still just as common to see people exchange business cards when they greet each other in a commercial environment. When receiving a card, always make sure you read it and even comment on it, if you like. This will ensure respectful acknowledgement of Chinese culture and etiquette.

Do you want to start selling beyond your shores? Discover which countries offer you the biggest opportunity, and just how to start - just drop us a line and we'll be in touch.

More articles you might be interested in:

ClickThrough's Head of International, Alison Booth, tells us how to increase your profits through untapped markets during a recession.

Read more

Welcome to the latest round-up of all things digital. This is where we look at the latest updates in the world of PPC, SEO, Content and International...

Read more

Find out more about the latest updates in digital marketing. Featuring key updates from Google, demystifying meta descriptions, and checking in on...

Read more

Episode eight of The Assorted Digital Ramblings podcast is now out! Learn more about International Marketing with guest Alison.

Read more

In this week's International Marketing News, Andrea takes us through personalisation and privacy in retail and much more. Read on.

Read more

In this week's International Marketing News, Andrea takes us through new .au domain extensions, Bitcoin ATMs and more. Read on.

Read more

Join Andrea Diaz for this week's International Marketing news, covering walled garden investigations and more.

Read more

In the International Marketing News this week, Andrea Diaz takes us through the importance of implementing omnichannel strategies in 2022, Huawei...

Read more