How To Drive Profits Through Untapped Markets During A Recession.

ClickThrough's Head of International, Alison Booth, tells us how to increase your profits through untapped markets during a recession.

Read moreFrom COVID-19's impact on eCommerce to China's online sales growth in 2021, you'll find all of the latest international marketing news in our round-up. Find out more.

This week in the International Newsletter: things to keep in mind in 2021 US Back-to-school, China's online sales growth during this year, how eCommerce impacted by the pandemic and the UK government postponing UKCA until January 2023.

According to Salesforce's Q2 Shopping Index, digital commerce growth began to level out in the second quarter of 2021. After a 63% increase in the first quarter of 2021, global eCommerce sales growth fell to low single digits (3%) in the three months to June 30th.

Despite a global slowdown in growth, Salesforce claims that consumers "stayed online and continued to boost sales for retailers." This is reflected in an increase in Average Order Value, which increased by 17% year over year to $90.64, despite a 1% decrease in the number of products ordered.

As some populations throughout the world return to socialising and travelling, online sales of luxury clothes, luxury handbags, and general handbags and luggage grew at the fastest rate this quarter. Meanwhile, Internet sales in the cosmetics and food and beverage industries have plummeted.

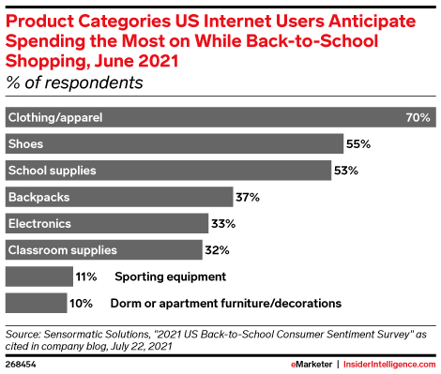

While analysts had projected a positive back-to-school (BTS) season for retailers and brands earlier this year, many parents still want their children's back to school to be as "normal" as possible.

Clothing and accessories are important categories.

Total consumer goods retail sales in China reached 3,492.5 billion Yuan in July 2021, up 8.5% year on year or 7.2% compared to June 2019, with an average growth rate of 3.6% over the previous two years.

Consumer goods sales, excluding autos, increased by 9.7% to 3,157.8 billion yuan. In July, overall retail sales of consumer products climbed by 6.4% excluding price effects.

In July, retail sales of urban consumer goods increased by 8.4% year on year to 3,037.9 billion Yuan, while retail sales of rural consumer goods increased by 8.8% to 454.7 billion Yuan.

Retail sales of products increased by 7.8% year on year to 3,117.4 billion Yuan, while catering revenue increased by 14.3% to 375.1 billion Yuan.

From January to July, total retail sales of social consumer goods reached 24,682.9 billion Yuan, up 20.7 % year on year, with an average growth rate of 4.3% over the two years.

Among them, retail sales of consumer goods other than automobiles increased by 20.2% to 22,163.1 billion Yuan.

If you've got any questions surrounding the news in this week's round-up, please do not hesitate to get in touch.

More articles you might be interested in:

ClickThrough's Head of International, Alison Booth, tells us how to increase your profits through untapped markets during a recession.

Read more

Welcome to the latest round-up of all things digital. This is where we look at the latest updates in the world of PPC, SEO, Content and International...

Read more

Find out more about the latest updates in digital marketing. Featuring key updates from Google, demystifying meta descriptions, and checking in on...

Read more

Episode eight of The Assorted Digital Ramblings podcast is now out! Learn more about International Marketing with guest Alison.

Read more

In this week's International Marketing News, Andrea takes us through personalisation and privacy in retail and much more. Read on.

Read more

In this week's International Marketing News, Andrea takes us through new .au domain extensions, Bitcoin ATMs and more. Read on.

Read more

Join Andrea Diaz for this week's International Marketing news, covering walled garden investigations and more.

Read more

In the International Marketing News this week, Andrea Diaz takes us through the importance of implementing omnichannel strategies in 2022, Huawei...

Read more