How To Drive Profits Through Untapped Markets During A Recession.

ClickThrough's Head of International, Alison Booth, tells us how to increase your profits through untapped markets during a recession.

Read moreIn this week’s international marketing roundup, Alison Humphries talks us through the impact of coronavirus on digital grocery, maintaining brand trust during a global pandemic and what businesses can learn from China’s livestreaming strategy.

What are the latest updates from the world of international marketing? In my latest news roundup I’ll be talking about how coronavirus has impacted digital grocery, maintaining brand trust during a crisis and what businesses need to know before livestreaming in China.

In her latest article published on Jing Daily, Ruonan Zheng talks us through how the pandemic has accelerated certain trading difficulties, including rising tariff costs that already exist with foreign direct investment in China. As a result foreign brands are facing the sky-high cost of digital spending and shifting market platform regulations which have become barriers that are affecting their ability to operate in China.

- Evidence their sustainability propositions and awareness of health-consciousness trends

- Streamline costs, enhance competitiveness and strengthen customer relationships through increased communication to drive greater engagement

To sum up, China is no longer the low hanging fruit to gain a new revenue stream. Companies with a greater chance of survival post-pandemic will need to have gained a strong foothold in the market and show evidence of embracing new consumption trends and relationships – both online and offline.

In his article on how coronavirus has impacted digital grocery, Blake Droesch outlines the increasing acceptance US consumers have for shopping online in the context of the digital grocery sector:

The role of digital in the consumer journey has continued to grow in importance as we have traversed through the pandemic, resulting in a change in the digital competitor landscape to reduce the dominance of top online market places, as they have reached their capacity to fulfil demand and create more options for consumers to shop digitally.

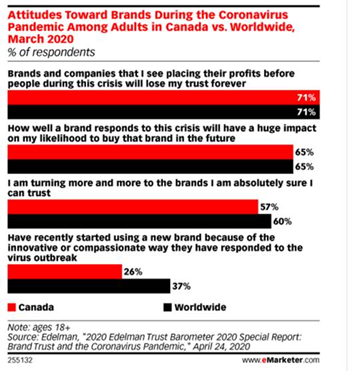

Consumer relationships built on trust can be lost quickly through making the wrong decisions, especially during times of crisis. In an article by Paul Briggs published on eMarketer, there is an analysis of Canada to see just how delicate these relationships can be:

A key learning to take from this is to clearly communicate brand values that outline how companies can help consumers in their time of need in order to build strong, long term relationships to become the go to brand for the product or service they need in the future.

The fight against 5G rampages move forward, with fiscal controls being implemented by US export officials to limit Chinese tech giant Huawei’s penetration into western markets.

Companies involved with the development, production and support of these products will need to review their current export licences. This leads to question of whether the efforts to scale up 5G coverage will be caught in an impasse.

Livestreaming is becoming an increasingly growing trend as a result of lock down, but what learnings can be taken from the livestreaming activity carried out in China? This activity could transcend to other markets in the future to guide on the best strategy to adopt to interrupt the consumer journey to purchase through this channel.

The key takeaways, here, are:

If you’d like to discuss any of the latest international marketing news included in this update, get in touch with our experts today. You can also tweet us @clickthrough.

More articles you might be interested in:

ClickThrough's Head of International, Alison Booth, tells us how to increase your profits through untapped markets during a recession.

Read more

Welcome to the latest round-up of all things digital. This is where we look at the latest updates in the world of PPC, SEO, Content and International...

Read more

Find out more about the latest updates in digital marketing. Featuring key updates from Google, demystifying meta descriptions, and checking in on...

Read more

Episode eight of The Assorted Digital Ramblings podcast is now out! Learn more about International Marketing with guest Alison.

Read more

In this week's International Marketing News, Andrea takes us through personalisation and privacy in retail and much more. Read on.

Read more

In this week's International Marketing News, Andrea takes us through new .au domain extensions, Bitcoin ATMs and more. Read on.

Read more

Join Andrea Diaz for this week's International Marketing news, covering walled garden investigations and more.

Read more

In the International Marketing News this week, Andrea Diaz takes us through the importance of implementing omnichannel strategies in 2022, Huawei...

Read more