How To Drive Profits Through Untapped Markets During A Recession.

ClickThrough's Head of International, Alison Booth, tells us how to increase your profits through untapped markets during a recession.

Read moreDiscover the latest international marketing news from our expert, Alison Humphries, who talks us through luxury brand recoveries in China and South Korea, and how US eCommerce is set to increase by 18% in 2020.

What's new, important and interesting in international marketing? This week we look at the reasoning behind TikTok’s temporary cessation of operations in the Hong Kong market, Instagram’s uptick in usage as a news source, a review of luxury brand post COVID-19 recoveries in China vs. South Korea and the positive uplift in US eCommerce activity this year.

If you have included TikTok in your Digital Marketing strategy for exporting to Hong Kong, you will need to review this temporarily. New York Times report that Google, Facebook and Twitter are questioning the new national security law for Hong Kong and have temporarily ceased processing Hong Kong government requests for user data as a result of the new legislation.

TikTok have jumped ahead and pulled their app from stores in Hong Kong and have made the app inaccessible to people there.

Hong Kong has permitted police to take down internet posts and penalise tech companies that do not comply with the data requests. This even goes as far as threatening to jail employees at internet companies for non-compliance with requests for user data.

Neither Facebook, Google nor Twitter has confirmed whether they will consider taking parts of the law on board. Their only action so far is to cease the provision of information from government requests. The legislative challenges from the Hong Kong government and the decision of the three companies will pave the future of internet freedom in the city amidst fears that a Chinese style control suffocation could ensue where Facebook, Google and Twitter are currently blocked.

Facebook stated that “they believe freedom of expression is a fundamental human right and support the right of people to express themselves without fear for their safety or other repercussions”.

Telegram, a popular messaging app in Hong Kong, have also ceased providing user data to the government and people reported being unable to download the TikTok app on Tuesday.

This has created huge concern amongst internet users in the city with many deleting posts, likes and even whole accounts in fear of facing a jail sentence of up to a year, as deemed by the new legislation for non-compliance with requests to remove posts.

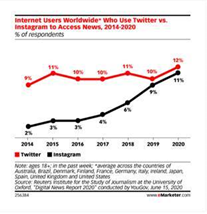

eMarketer report that a fairly equal number of users seek news content from Instagram and Twitter. The Reuters Digital News Report found that 11% of respondents across the 12 countries surveyed use Instagram as a news source (nearly double the amount in 2018) and 12% use Twitter.

Overall, 12% of adults surveyed used Instagram for corona virus related news in April, yet 26% of 18-24 year olds used it for this purpose. This is likely to be due to the preference for consuming news content in a more visual format.

Brand safety may present itself as a problem if Instagram becomes a top news source, as it has previously been viewed as a lifestyle orientated platform. Consequently, brands could start to see political influences impacting on their Digital Marketing strategy, as they have done with Facebook and Twitter.

Recent nationwide protests have resulted in brands receiving backlash for continuing to advertise during these periods. If Instagram’s users start to engage with sensitive and controversial news content, this could increase the negativity of engagement with the platform, which may require Instagram to step in to safeguard brand safety as Twitter have done with preventing ads from showing next to ‘hate speech posts’.

As the markets that are first to recover from COVID-19, Jing report on the differences between China and South Korea’s luxury brands’ experiences post lockdown. The question remains whether there are any key learnings we can take from their experiences.

Agility Insights China and Korea 2020 Rebound Report showed that China’s recovery was much quicker than South Korea. The virus was identified around half a month earlier in China, yet luxury brands had reached 60-70% of their trading levels in March with subsequent weekly increases into April.

However, public facilities were not reopened in South Korea until 22nd April following more relaxed lockdown measures. Needless to say, consumer demand focused around premium goods in malls and department stores.

Shopping online is the norm for Chinese consumers whereas South Koreans were warming up to the concept and only tended to buy necessities rather than luxury goods online. However, the Hyundai department store paved the way by launching the first online fashion show on YouTube.

The aforementioned report found that livestreaming offered greater entertainment value for South Koreans, which looks to be a trend set to continue in the future.

Consumer sentiment is naturally a key consideration when devising your Digital Marketing strategy. South Korean Gen Zers hold financial success as a core value, while health is more intrinsic to their Chinese counterparts. Luxury brands enabled the South Koreans to reward themselves and enjoy their quality of life –values for the brands to focus on delivering in their digital promotions.

Revenge spend post lockdown prevailed in both markets, paving the way to an uplift in sales for brands that had continued to communicate with their audiences through lockdown.

Domestic travel and tourism saw an uplift in May for Korea, yet air travel started to see a rise in demand by the end of February in China. Both countries saw hotel occupancy of 60% through the Golden Week Holiday and Korean Air added domestic flights in May and planned to open 19 international routes in June.

The recovery of the Korean luxury brand market is dependent on inbound tourism from China. Until travel restrictions are removed for Chinese tourists, recovery will be slower. This could be a similar issue for brand in other markets dependent on international inbound tourism to drive retail sales.

Current market forecasts indicate that Korea may be able to open up to international tourists between July and August to boost luxury retail product sales.

Korea is likely to see a significant shift towards shopping online following lockdown, which is a trend we are likely to see across many different international markets.

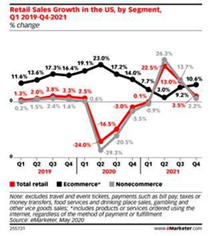

eMarketer forecasts indicated a growth of 2.8% in US retail sales in February, but this fell to an expected decline of 10.5% for the year and 14% in brick and mortar stores. Despite the negative outlook, eCommerce is predicted to grow by 18%.

If you’d like to discuss any of the latest international marketing news included in this update, get in touch with our experts today.

More articles you might be interested in:

ClickThrough's Head of International, Alison Booth, tells us how to increase your profits through untapped markets during a recession.

Read more

Welcome to the latest round-up of all things digital. This is where we look at the latest updates in the world of PPC, SEO, Content and International...

Read more

Find out more about the latest updates in digital marketing. Featuring key updates from Google, demystifying meta descriptions, and checking in on...

Read more

Episode eight of The Assorted Digital Ramblings podcast is now out! Learn more about International Marketing with guest Alison.

Read more

In this week's International Marketing News, Andrea takes us through personalisation and privacy in retail and much more. Read on.

Read more

In this week's International Marketing News, Andrea takes us through new .au domain extensions, Bitcoin ATMs and more. Read on.

Read more

Join Andrea Diaz for this week's International Marketing news, covering walled garden investigations and more.

Read more

In the International Marketing News this week, Andrea Diaz takes us through the importance of implementing omnichannel strategies in 2022, Huawei...

Read more