How To Drive Profits Through Untapped Markets During A Recession.

ClickThrough's Head of International, Alison Booth, tells us how to increase your profits through untapped markets during a recession.

Read moreDiscover the latest international marketing news from our expert, Alison Humphries, who talks us through how the ongoing impact of COVID-19 is affecting markets around the world.

What are the latest news stories from the world of international marketing? In this article I’ll be talking about the ongoing impact of COVID-19, and what this means for markets around the world. From the consumption of digital media and TV in China, to the rise in popularity of TikTok since quarantine measures were implemented.

According to eMarketer, the COVID-19 pandemic has led to an increase in the consumption of digital media and TV in China due to people being very cautious and staying at home. There has been a month on month average increase of 4 minutes from March, rising to 6 hours 58 minutes. eMarketer estimate that 2:45 could be spent viewing traditional TV and the remaining time will be spent perusing digital media. The expectation for the consumption of digital media is for this to continue to grow moving forwards.

These are trends we need to monitor across all markets to ensure budget allocation is weighted towards the channels, and through media where it is likely to have the greatest impact.

The rise in popularity of TikTok (the social video app from China) in the US has been explosive since quarantine was implemented. The Center for Trade & International Studies (CSIS) estimate that over 2 billion apps have been downloaded globally, and 165 million in the US. However, the review of the Committee on Foreign Investment in the United States (CFIUS) into ByteDance, TikTok’s parent company, could impact heavily on the future usage of the app in the US.

The question remains open as to whether the consumption of digital video content amongst the American millennials and Gen Z will be set to change in the near future, and the subsequent impact this could have on investment in TikTok ad spend and production of organic content.

In a recent article published by eMarketer, a survey carried out by the China Tourism Academy and Trip.com shows that domestic travel may start to see signs of recovery this month in China. The highest number of respondents cited short-to-medium trips as their preferred journeys for their first post lockdown travel experience. This provides a potential glimmer of hope for the travel hungry, by the most advanced in weathering the impacts of COVID-19.

115 million trips were made over the Chinese Labor Holiday (1st-5th May), which was just under 60% of the total for the same period in 2019. Another notable event was the reopening of the Shanghai Disneyland Park on 11th May, social distancing well accounted for and tickets sold out within minutes.

The growth in demand for travel in China may help to map the future of this sector for markets less mature in the impacts of COVID-19 to guide on anticipating when to start pushing budgets again.

Google has explored macro shifts in consumer behaviour to predict what the impacts will be post lockdown, and have covered five main themes to demonstrate this.

People are closely monitoring the latest COVID-19 rules, with searchers in Germany frequently trying to determine ‘what is allowed’ (‘was ist erlaubt’) and ‘curfew permit’ (‘izin belgesi’) in Turkey. But people across many markets including Denmark, the Netherlands, the UK and many others are also hoping for a return to normal with searches relating to ‘when will … reopen’ (i.e. hairdressers, schools etc.).

Consumers are concerned about financial security – in Denmark students are seeking financial support (‘SU lan’), interest in ‘unemployment benefit’ ('prestación por desempleo') in Spain and ‘job centre’ ('urząd pracy') in Poland.

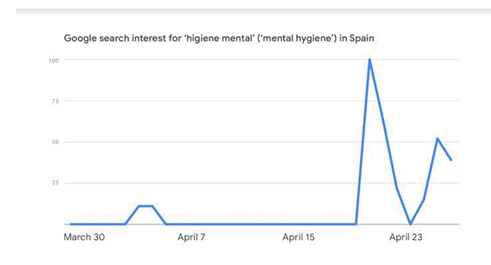

People are keen to stay healthy, both physically and mentally – the inability to go the gym and having more time to cook and bake has given rise to searches for ‘mental hygiene’ ('higiene mental') in Spain, ‘healthy recipes’ (‘gezonde recepten’) in the Netherlands, and ‘vitamin d’ in the UK.

Educational tools and platforms have significantly increased in popularity as people are looking to home school their children, but also to enhance their own skills with searches such as ‘smartschool’ in Belgium, online exam ('online sınav') and ‘software training’ ('yazılım eğitimi') in Turkey, tipping Google Trends latest queries.

People have found new ways to spend their time at home and in outdoor spaces with searches emerging such as ‘Woningsdag’ (‘home day’) a lockdown-friendly variation of ‘Koningsdag’ (‘King’s Day’) in the Netherlands, equipment and locations ‘for running’ (‘do biegania’) in Poland, ‘outdoor furniture’ ('utemöbler rusta') in Sweden, ‘bingo’ in Denmark and ‘old-fashioned Dutch games’ (‘oud hollandse spelletjes’) in the Netherlands to keep people entertained at home.

These search trends outline new opportunities to take advantage of promoting alternative uses for products or pushing products that may not previously have been top sellers due to these changes in consumer behaviour.

Econsultancy have collated the latest impactful weekly stats to outline the effects the Coronavirus is having on different sectors across the global economy. Here is a snapshot of some of their findings:

These are some clear indicators of significant changes in consumer behaviour that could impact future strategy and channel allocation of marketing budgets.

If you’d like to discuss any of the latest international marketing news included in this update, get in touch with our experts today.

More articles you might be interested in:

ClickThrough's Head of International, Alison Booth, tells us how to increase your profits through untapped markets during a recession.

Read more

Welcome to the latest round-up of all things digital. This is where we look at the latest updates in the world of PPC, SEO, Content and International...

Read more

Find out more about the latest updates in digital marketing. Featuring key updates from Google, demystifying meta descriptions, and checking in on...

Read more

Episode eight of The Assorted Digital Ramblings podcast is now out! Learn more about International Marketing with guest Alison.

Read more

In this week's International Marketing News, Andrea takes us through personalisation and privacy in retail and much more. Read on.

Read more

In this week's International Marketing News, Andrea takes us through new .au domain extensions, Bitcoin ATMs and more. Read on.

Read more

Join Andrea Diaz for this week's International Marketing news, covering walled garden investigations and more.

Read more

In the International Marketing News this week, Andrea Diaz takes us through the importance of implementing omnichannel strategies in 2022, Huawei...

Read more