How To Drive Profits Through Untapped Markets During A Recession.

ClickThrough's Head of International, Alison Booth, tells us how to increase your profits through untapped markets during a recession.

Read moreClickThrough's Head of International Marketing, Alison Humphries, talks us through the latest news stories from this week. From the top Black Friday trends of 2020 to Netflix expanding into Asia, read more.

What's new, important and interesting in international marketing? This week we look at key trends notable from the run up to Black Friday 2020, changes in the channels consumers are using for product searches, assessment of the current progress towards a UK-EU trade deal and considerations brands could observe from Netflix’s experiences in entering the Asian market.

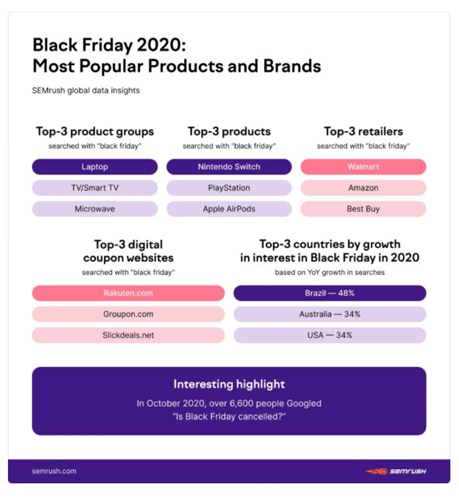

SEMrush carried out a thorough investigation into key trends, activities of top retailers and Amazon products to predict how performance could look over the Black Friday period. Have you seen similar trends and are there learnings you could take forward for next year?

Most popular products had a strong alignment with the purchase trends that have emerged over lockdown.

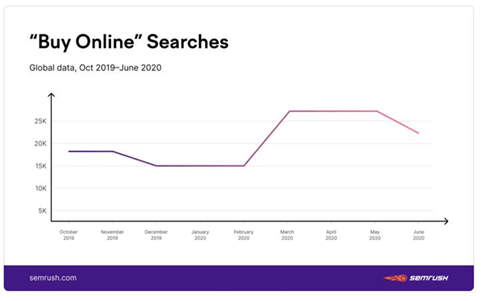

“Buy online” searches increased by 50% YoY. Could there be an uplift in similar searches next year, as people become even more comfortable with transacting online?

63% of US consumers avoided shopping in store and retailers like Target, Lowe’s and Walmart kept their doors closed over Thanksgiving in response.

Sustainable products queries increased by 650% YoY. Ikea have responded through their “buy back old furniture” campaign to attract a more environmentally-friendly consumer.

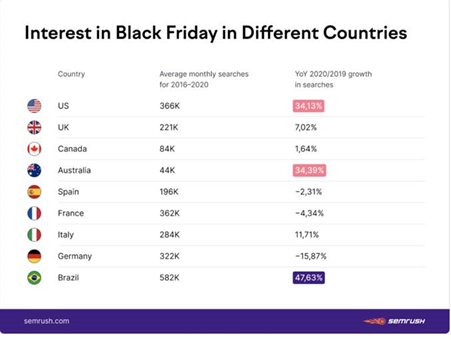

Interest in Black Friday has taken different directions YoY with Western Europe declining (bar the UK and Italy) and a surge in US, Australia and Brazil.

For the first time ever, people sought to find out whether Black Friday was cancelled.

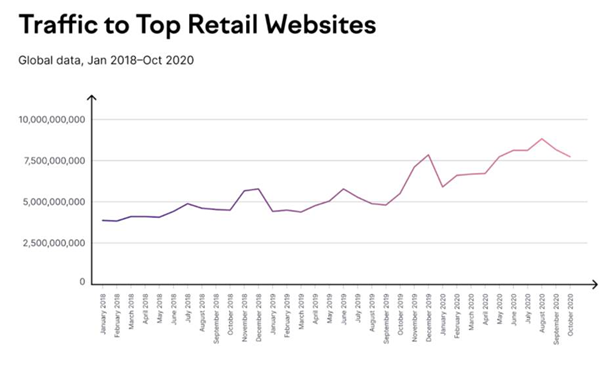

Traffic to major retailers hit an all-time high.

Laptops and TVs were the most popular products searched for in the run up to Black Friday. Flights were still in the top ten despite the pandemic.

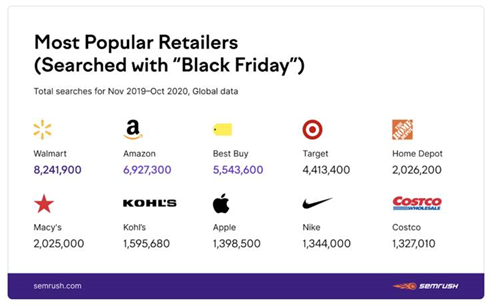

Nike and Kohl’s made it into the top ten retailers over the past twelve months.

Air Pods, Amazon Echo devices and PS5 topped the list for the consumer electronics products on Amazon in October 2020.

An analysis of YoY ad spend highlighted that advertisers with budgets below $1k made cuts averaging 13% in October 2020, whereas those spending $1k-$10k increased spend by 11%.

In taking these trends to plan future Black Friday activity, don’t forget to factor in how you can target voice search.

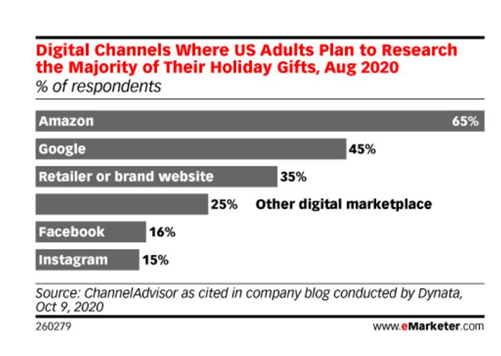

eMarketer have uncovered that US consumers are heading to market places to start their product searches. A recent survey conducted by Dynata highlighted that 53% of respondents favoured Amazon to start their journey to convert.

Amazon also looks set to be the channel of choice to find holiday gift ideas.

Despite the increased presence of ads on the Amazon first search page results, consumers didn’t feel that this negatively impacted their shopping experience. Gen Z users had a great tendency to report that ads had a negative effect on their buying experience.

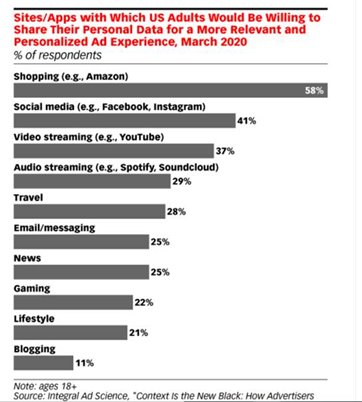

A survey by Integral A Science found that people are more willing to share personal data with Amazon than they are with other channels offering personalised ad activity.

Wunder Thompson’s survey highlighted that 82% of respondents wished more brands offered retail services like Amazon, and 54% were worried about Amazon’s dominance.

The Institute of Export & International Trade summarise the latest developments with the UK-EU trade talks, finding that a deal remains out of reach as the French push for a hardening of the EU stance on fisheries and state-aid.

EU negotiator, Michel Barnier, reigns in discussions, as the EU members states fear too much has been conceded during the negotiations.

A deal needs to be made today, as the Internal Market returns to the Commons and the EU Council meet for the last time this year, requiring documents with details proposing the deal in their own languages in order to reach an agreement.

Switzerland are likely to reach on deal on reciprocal unrestricted business travel to maintain and grow their 3.3% share of UK export trade.

Jing outline the key takeaways from Netflix’s recent move into the Asia Pacific market.

Wondering how international marketing might work for your business? Get in touch with our experts to find out more about our services.

More articles you might be interested in:

ClickThrough's Head of International, Alison Booth, tells us how to increase your profits through untapped markets during a recession.

Read more

Welcome to the latest round-up of all things digital. This is where we look at the latest updates in the world of PPC, SEO, Content and International...

Read more

Find out more about the latest updates in digital marketing. Featuring key updates from Google, demystifying meta descriptions, and checking in on...

Read more

Episode eight of The Assorted Digital Ramblings podcast is now out! Learn more about International Marketing with guest Alison.

Read more

In this week's International Marketing News, Andrea takes us through personalisation and privacy in retail and much more. Read on.

Read more

In this week's International Marketing News, Andrea takes us through new .au domain extensions, Bitcoin ATMs and more. Read on.

Read more

Join Andrea Diaz for this week's International Marketing news, covering walled garden investigations and more.

Read more

In the International Marketing News this week, Andrea Diaz takes us through the importance of implementing omnichannel strategies in 2022, Huawei...

Read more