Key Tips From Each Marketing Channel to Supercharge Black Friday

The days are getting shorter, the temperature's getting colder and conversations are starting to turn toward getting ready for Christmas. Yes, we're...

Read moreWhat does Amazon's Prime Early Access Sale mean for e-commerce holiday spending? We review why peak customer purchase intent is coming earlier every year.

First, it was Black Friday. Then it was Cyber Week. Next came Black November, where peak season shoppers could find the discounts, they craved for an entire month of the year. But has peak season prevalence stopped there?

On October 11th 2022, Amazon held their inaugural Prime Early Access sale, essentially launching the second iteration of their infamous ‘Amazon Prime Day.’ Commonly known as Black Friday’s rival as the best discount period of the year, does this move by Amazon indicate a further shift in consumer purchase intent creeping earlier and lasting longer than ever before?

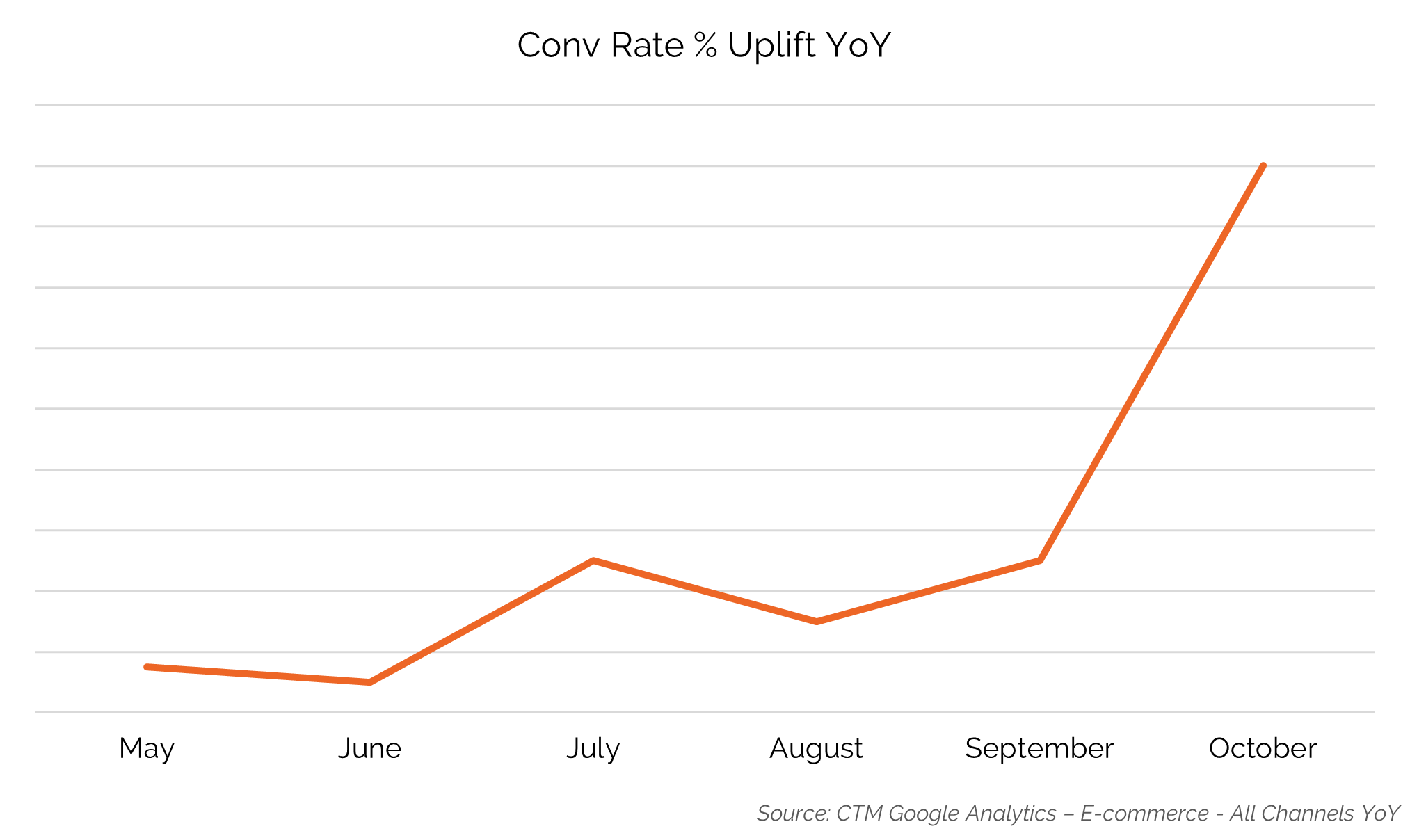

Here at ClickThrough Marketing, we always want to put a good theory to the test with some deeper analysis, the results of which were intriguing to say the least:

The conversion rate uplift across our e-commerce client base certainly supports the theory that consumers are very much in the holiday shopping spirit so far in October, particularly compared to last year.

To add a bit of substance to our findings, we reached out to one of our clients to share their thoughts on the recent uptick in results:

Adam Hirst – Woolroom - Head of Digital

‘We’re really happy with the return we’ve achieved in October so far. It’s great to see the hard work that we and the team at ClickThrough put in for our peak period is paying off even earlier than expected!’

Interestingly, it is the retailers offering some form of October discount who are benefitting the most from this uplift in conversion intent, which aligns with a pattern of behaviour identified earlier in the year against the backdrop of the cost-of-living crisis:

This flurry of discounting looks set to change the shopping trends over this holiday season Bluedot’s consumer survey outlined that consumers in the US have been saving up for their holiday purchases with 48% of the respondents actively looking for deals, and retailers are stepping up to meet this demand. While 31% are shopping earlier regardless of deals and the remainder are cutting back on their expenses.

Retailers have been struggling under excess inventory after consumers pulled back on spending when utilities and fuel prices skyrocketed in March and April, and some have been discounting for months to reduce surplus stock levels.

The combination of early discounting and pressure on consumers’ budgets seems to be instigating a growth in consumer spending that we would expect to see later in the year in the build-up to and during the Cyber Five period.

The question remains - should paid advertising budgets be ramped up ahead of previous Black Friday peak? Adobe forecasted that while we will see a 2.8% YoY growth in sales due to more people becoming accustomed to shopping online, Cyber Five’s share of the total holiday sales may fall by 0.3% with Black Friday contributing less and Cyber Monday remaining the biggest shopping day of the year.

Three categories are expected to contribute to half of Cyber Five spending; electronics will be the top performer with an anticipated 2.9% growth over Cyber Five, apparel is forecasted to be down by 6.7% YoY, while groceries are anticipated to see double-digit growth to $13.3 billion globally.

Retailers will have the greatest chance of success through making it clear that consumers need their products. Naturally, price is going to be a key factor in consumers’ decision-making, but promotions should be focused on creating the urgency to buy. Equally, offering a variety of payment methods will facilitate the ease of consumers being able to afford the products they are seeking to buy.

Outlining the service offered will be key to turning consumers’ heads, for example, faster delivery and order tracking are key factors in the decision to purchase, particularly when people are buying Christmas presents. Trust underpins many transactions, so it is key to seek to win this to start to build longer-term relationships with consumers to encourage repeat purchases.

Communicating with consumers about how they can seek comfort from your products could be a way to cut through the noise. Mcdonald's and Burger King have sought to evoke nostalgia, by bringing back previously sought-after products in the case of McDonald's, while Burger King have referenced the well-known 1970s jingle “Have It Your Way”

Retailers are struggling to predict the impact the changing consumer behaviour will have on their revenue over the holiday season. However, while demand remains so high and consumers look to be starting their holiday shopping earlier, we at ClickThrough will be keeping budgets at a higher level than originally forecasted for October to maintain visibility to meet demand and promote product and service benefits beyond price to pique interest.

Photo by Erik Mclean on Unsplash

More articles you might be interested in:

The days are getting shorter, the temperature's getting colder and conversations are starting to turn toward getting ready for Christmas. Yes, we're...

Read more

The early bird catches the worm - and it's no different with Black Friday strategy. Despite the shopping event not happening until the end of...

Read more

Black Friday is equally as demanding for Digital Marketing professionals as it is for the consumers. While shoppers navigate crowded shops in search...

Read more

Now is the best time to get ahead of the game and start planning your Black Friday Paid Social ads. The big day may still be two months away, but...

Read more

It may appear straightforward, yet it is often underestimated. A top landing page is essential for maximising success during Black Friday sales. If...

Read more.png)

During the early 2010s, American-owned retailers in the United Kingdom, such as Amazon and Asda, jumped on the trend of U.S. style Black Friday...

Read more

Just as the England squad comes together for their winter World Cup campaign, ClickThrough Marketing is here to help your digital channels do the...

Read more

The Qatar World Cup offers marketers a one-time-only opportunity to utilise a major sporting event during peak periods – but is it worth dismissing...

Read more